KPI Dashboard

What are account statements? KPI dashboards are dynamic data visualization tools that display key performance indicators and metrics in a clear, concise, and visually appealing format. They provide stakeholders with real-time insights into various aspects of business performance, allowing them to monitor progress, identify trends, and make informed decisions.

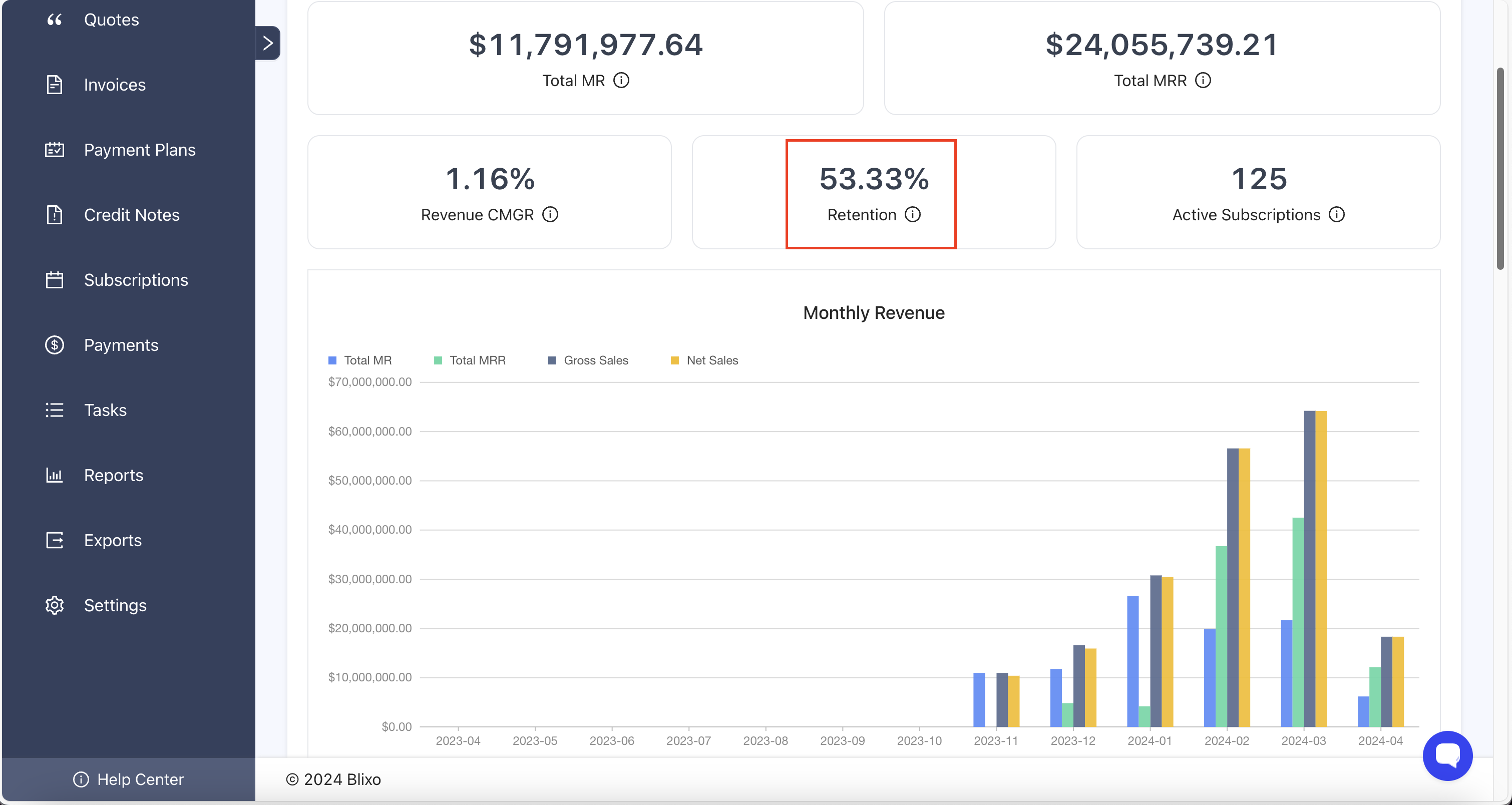

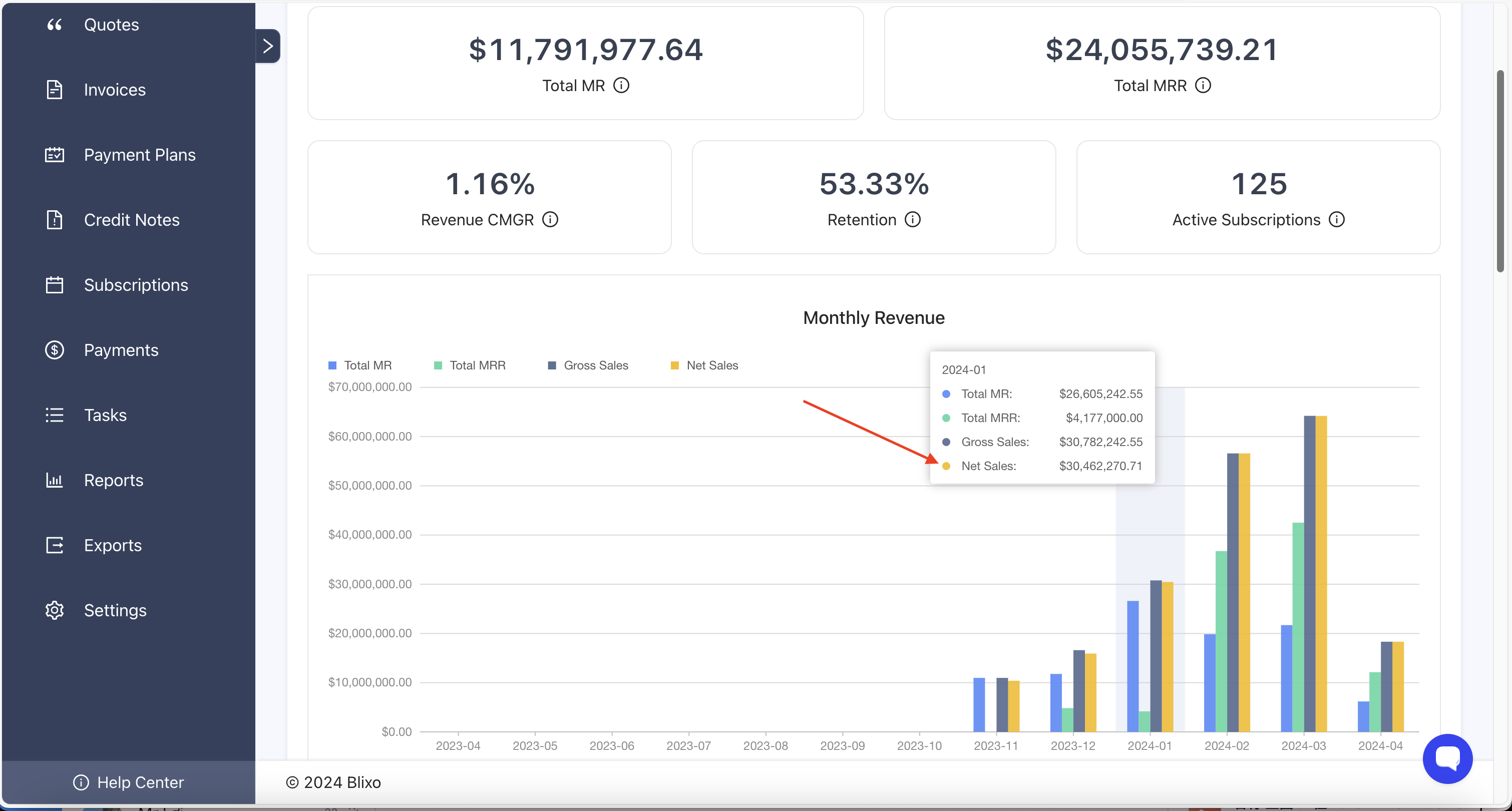

Our platform enables you to effortlessly view diverse KPI metrics after successfully logging into Blixo, including:

- Total Monthly Revenue (MR)

- Total Monthly Recurring Revenue (MRR)

- Revenue Compound Monthly Growth Rate (CMGR)

- Retention Rate

- Total Active Subscriptions

- Gross Sales

- Net Sales

- Customer Retention

- Collections

- Customer Metrics

- DSO (Accounts Receivable / Past Year Total Sales x 365)

- Time to pay (Average time for invoices to be paid over past year)

- Unpaid Invoices

- Expected Payments (Promises to Pay + AutoPay)

- CEI (Ratio of invoices that have been collected over past year)

- A/R Balance

- Unpaid Amount

- Activity

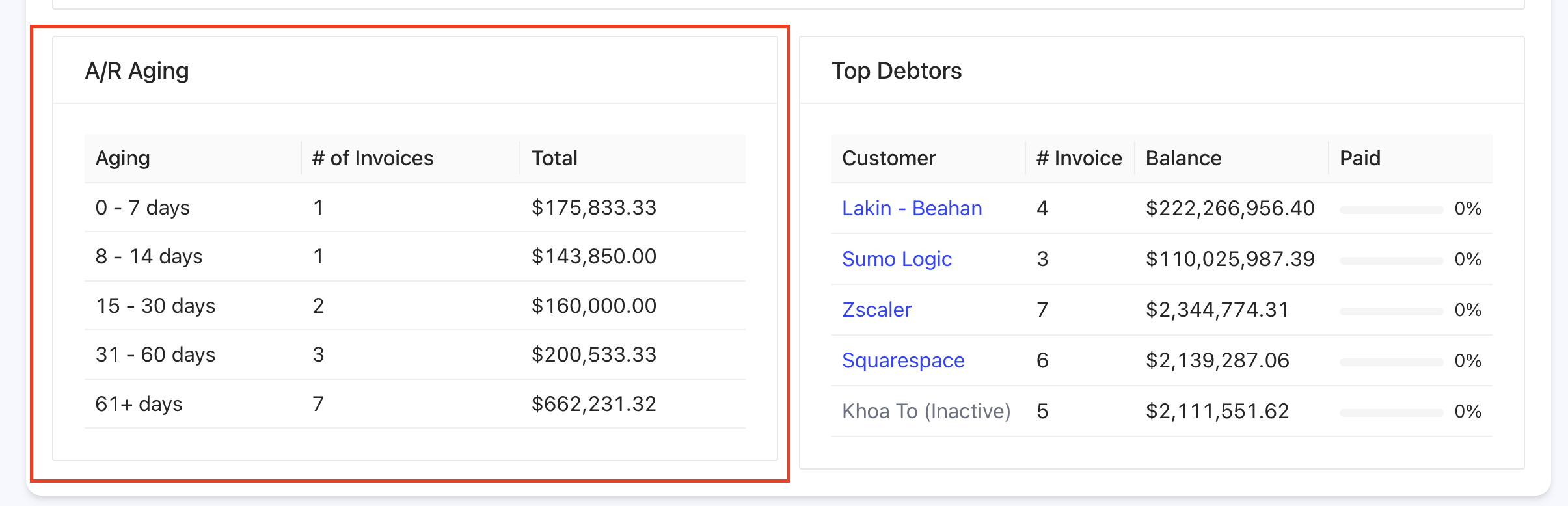

- A/R Aging

- Top Debtors

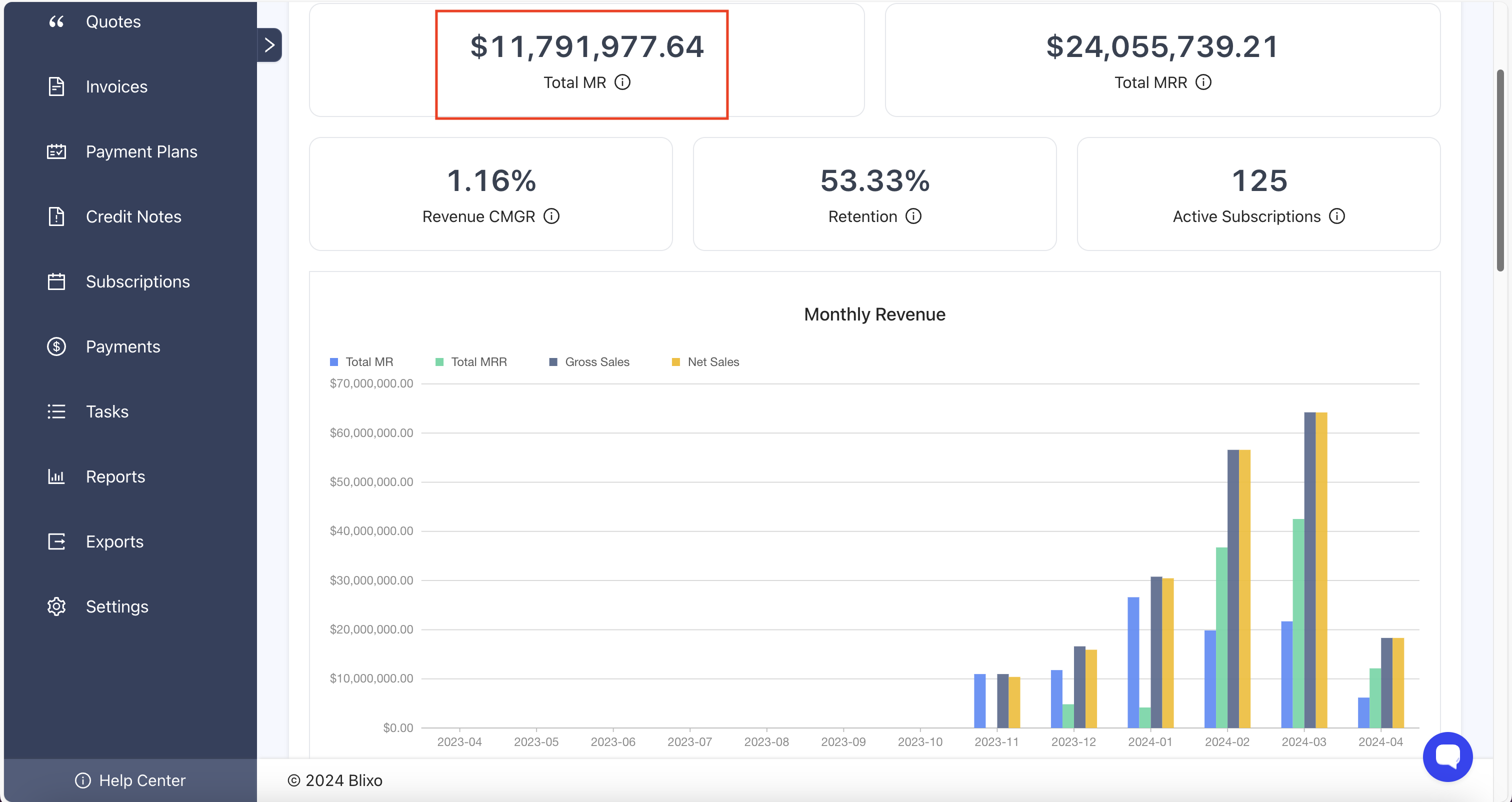

Total Monthly Revenue (MR)

The Total Monthly Revenue (MR) metric serves as a crucial indicator of financial performance, providing a comprehensive snapshot of the revenue generated within a specific time frame. This documentation elucidates the significance of Total Monthly Revenue, its calculation methodology, and its pivotal role in strategic decision-making and performance evaluation.

To calculate Total Monthly Revenue (MR), simply sum up all sources of revenue earned by the business during the given month. This includes income generated from product sales, service fees, subscriptions, and any other revenue streams relevant to your business model.

Total Monthly Revenue (MR) offers valuable insights into the health of your business. By tracking MR over time, you can identify patterns, trends, and seasonality in your revenue streams. Additionally, MR serves as a benchmark for setting financial goals, assessing performance against targets, and making informed strategic decisions.

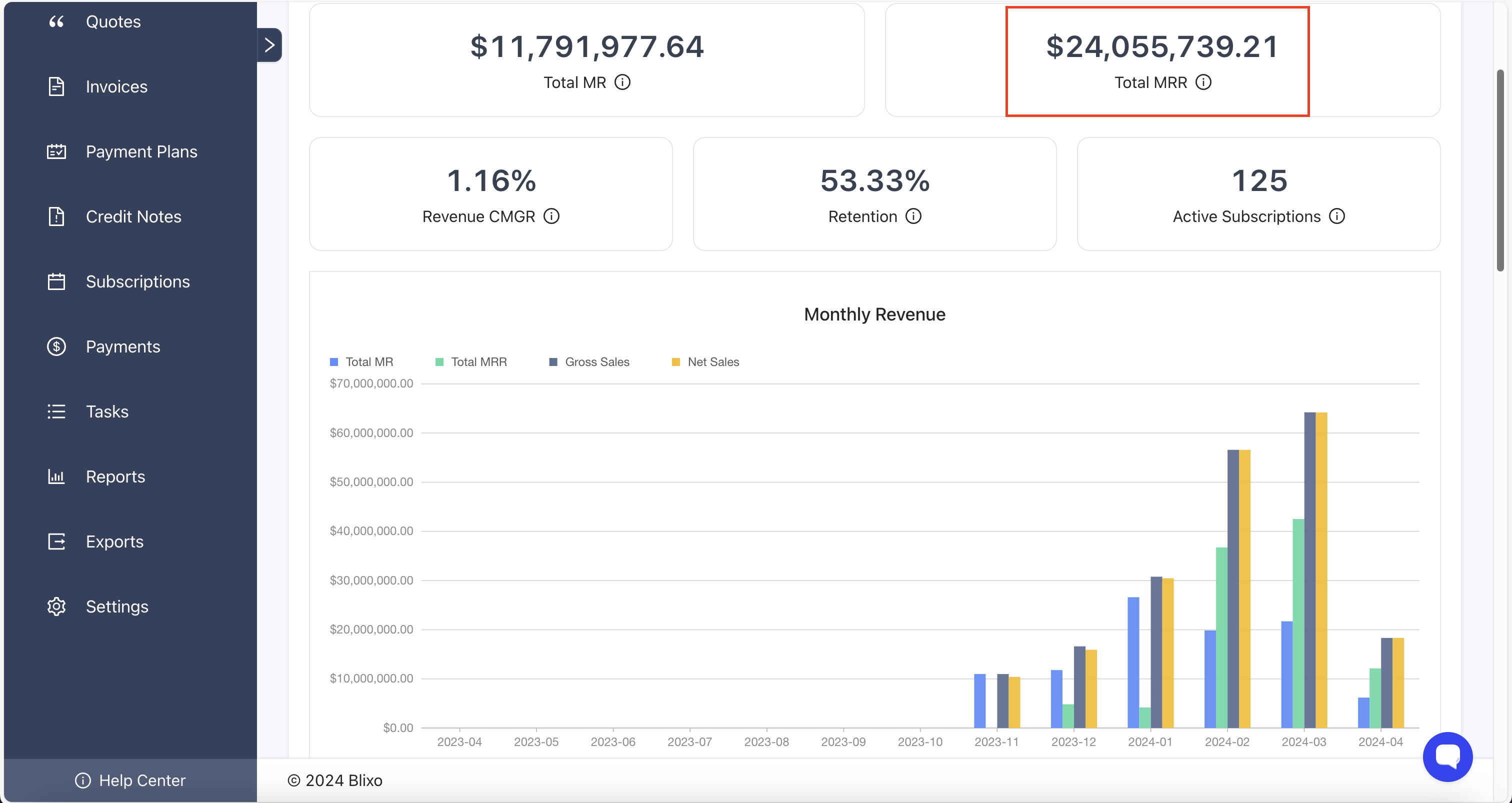

Total Monthly Recurring Revenue (MRR)

Total Monthly Recurring Revenue (MRR) is a key metric used by subscription-based businesses to measure the predictable and recurring revenue generated from subscription fees within a single month. It encompasses all revenue generated from ongoing subscriptions, excluding one-time payments, upsells, or other non-recurring revenue sources.

MRR can be calculated using various methods depending on the complexity of your subscription model. The most common approach is to sum the monthly recurring revenue from all active subscriptions within a given month. This includes revenue from different subscription tiers, add-ons, and upgrades, while excluding any discounts or refunds.

Formula for MRR Calculation: MRR = Sum of Monthly Subscription Fees

For businesses with multiple subscription plans or pricing tiers, MRR can be further segmented to analyze revenue contributions from each segment separately. Additionally, it’s essential to consider churn (loss of revenue due to cancellations or downgrades) and expansion (increase in revenue from upsells or upgrades) when calculating MRR to obtain a more accurate representation of net revenue growth.

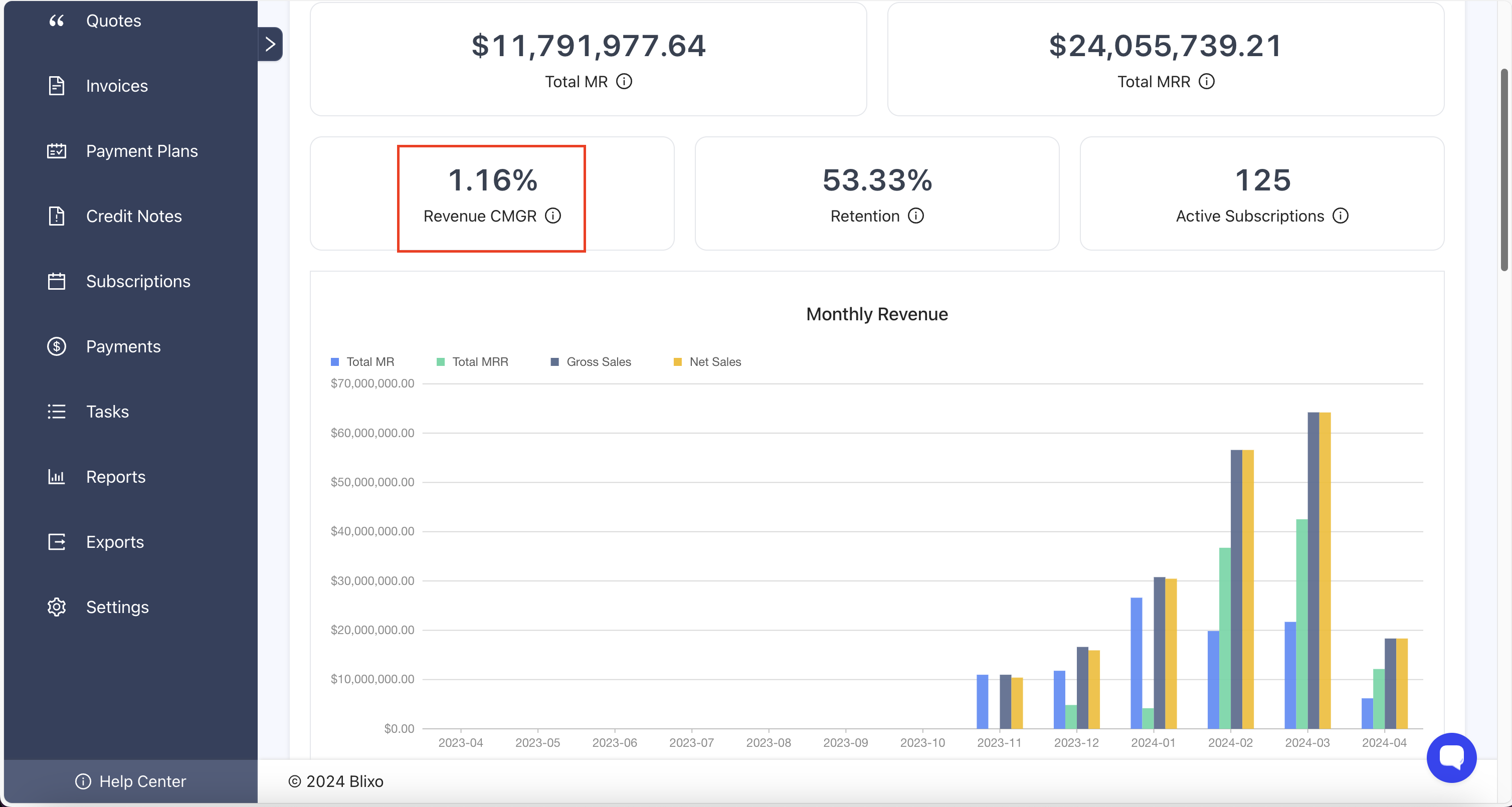

Revenue Compound Monthly Growth Rate (CMGR)

The Revenue Compound Monthly Growth Rate (CMGR) is a crucial financial metric used to measure the month-over-month growth rate of a company’s revenue. It calculates the constant rate of growth that would have produced the current revenue from a specified starting point, assuming the revenue grew at a steady monthly rate.

CMGR can be calculated using the following formula: CMGR = ((Revenue at the end of the period / Revenue at the beginning of the period)^(1/n)) - 1

Example: Let’s consider a hypothetical scenario:

Revenue at the beginning of the month: $10,000

Revenue at the end of the month: $15,000

Number of months: 1

Using the formula:

CMGR = (($15,000 / $10,000)^(1/1)) - 1 = (1.5^(1/1)) - 1 = (1.5^1) - 1 = 1.5 - 1 = 0.5

So, the CMGR for this period is 50%.

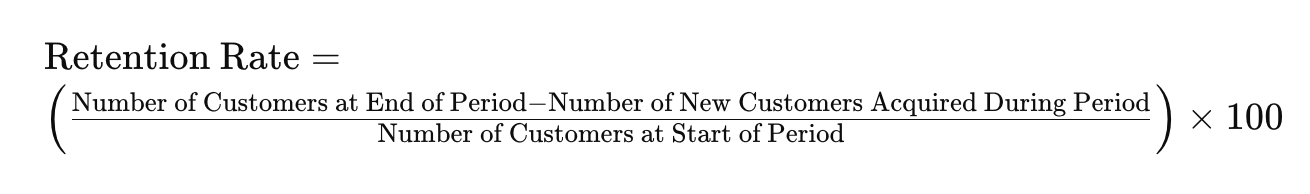

Retention Rate

Retention rate refers to the percentage of customers or users that a business retains over a certain period. It measures the ability of a company to keep its customers engaged and satisfied, thereby reducing churn and increasing customer lifetime value (CLV). A high retention rate indicates strong customer loyalty and a healthy business model.

Retention rate is typically calculated over a specific period, such as a month, quarter, or year. The formula for calculating retention rate is as follows:

Retaining existing customers is often more cost-effective than acquiring new ones. A high retention rate can lead to increased revenue, as loyal customers tend to make repeat purchases and are more likely to recommend the business to others. Moreover, retaining customers fosters brand loyalty and enhances the overall reputation of the company.

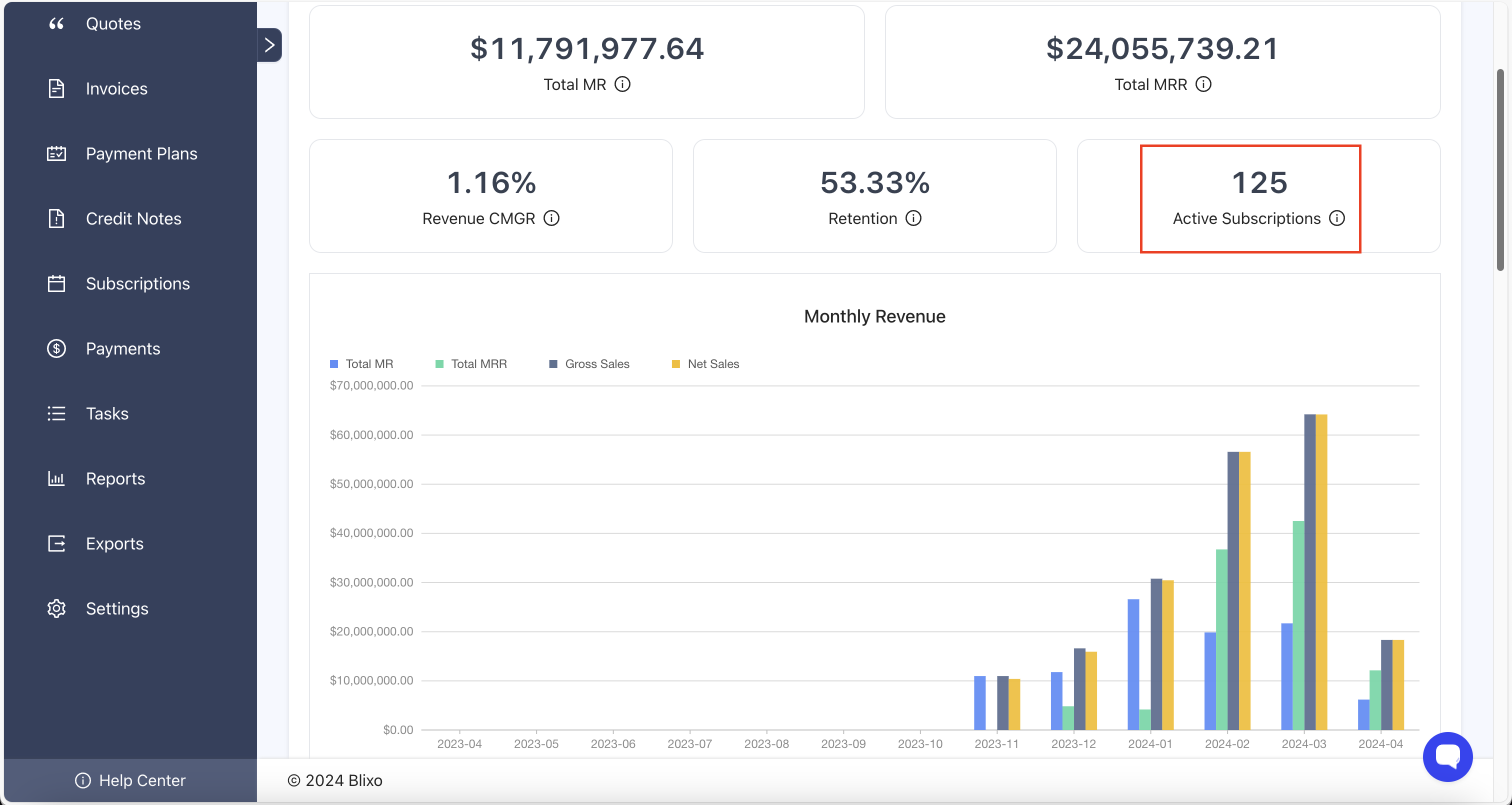

Total Active Subscriptions

Total Active Subscriptions refer to the cumulative number of ongoing subscriptions within a specified time frame. These subscriptions are typically associated with a service or product offered by your business and are actively generating recurring revenue. It serves as a vital metric for assessing the health and success of your subscription-based business model. By tracking the total number of active subscriptions over time, you can gain valuable insights into trends, customer retention, and revenue generation.

The calculation of Total Active Subscriptions is straightforward. It involves summing up all the individual subscriptions that are currently active within the designated period. This includes both new subscriptions acquired during the period and existing subscriptions that have been renewed or retained

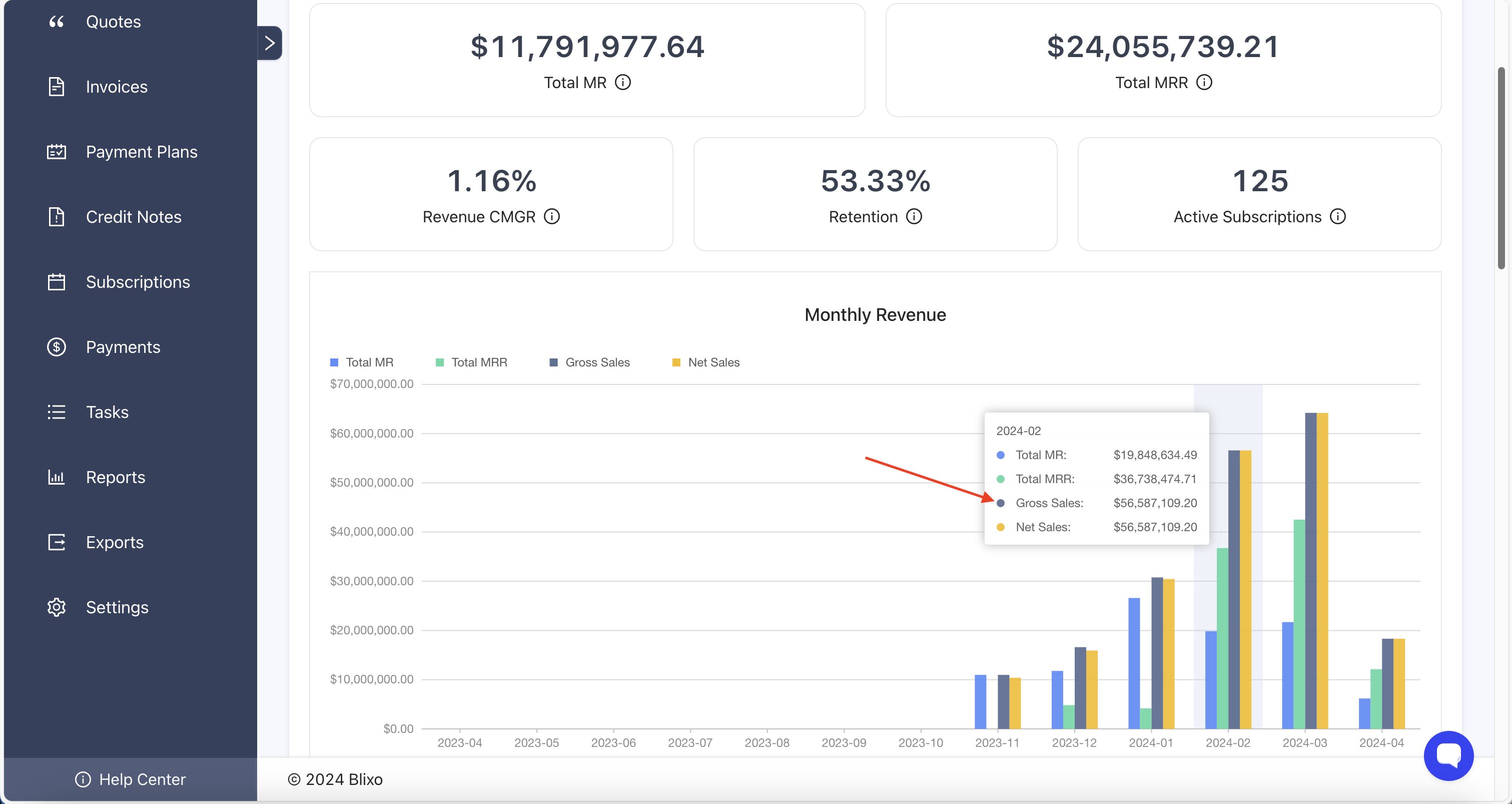

Gross Sales

Gross Sales represent the total revenue generated by a business from the sale of goods or services before any deductions are made for expenses such as discounts, returns, or allowances. It is a critical indicator of the overall financial health and performance of a company.

The formula for calculating Gross Sales is as follows:

Gross Sales = Total Revenue from Sales

Net Sales

Net sales represent the total revenue generated by a company after deducting returns, discounts, and allowances from gross sales. It is a crucial metric that provides insight into the effectiveness of a company’s sales strategies and performance in generating revenue.

Calculating Net Sales

Net Sales = Gross Sales − Returns − Discounts − Allowances

- Gross Sales: Total sales revenue generated by the company.

- Returns: Amount refunded to customers due to product returns.

- Discounts: Reductions in the selling price offered to customers.

- Allowances: Deductions granted to customers for damaged or defective products.

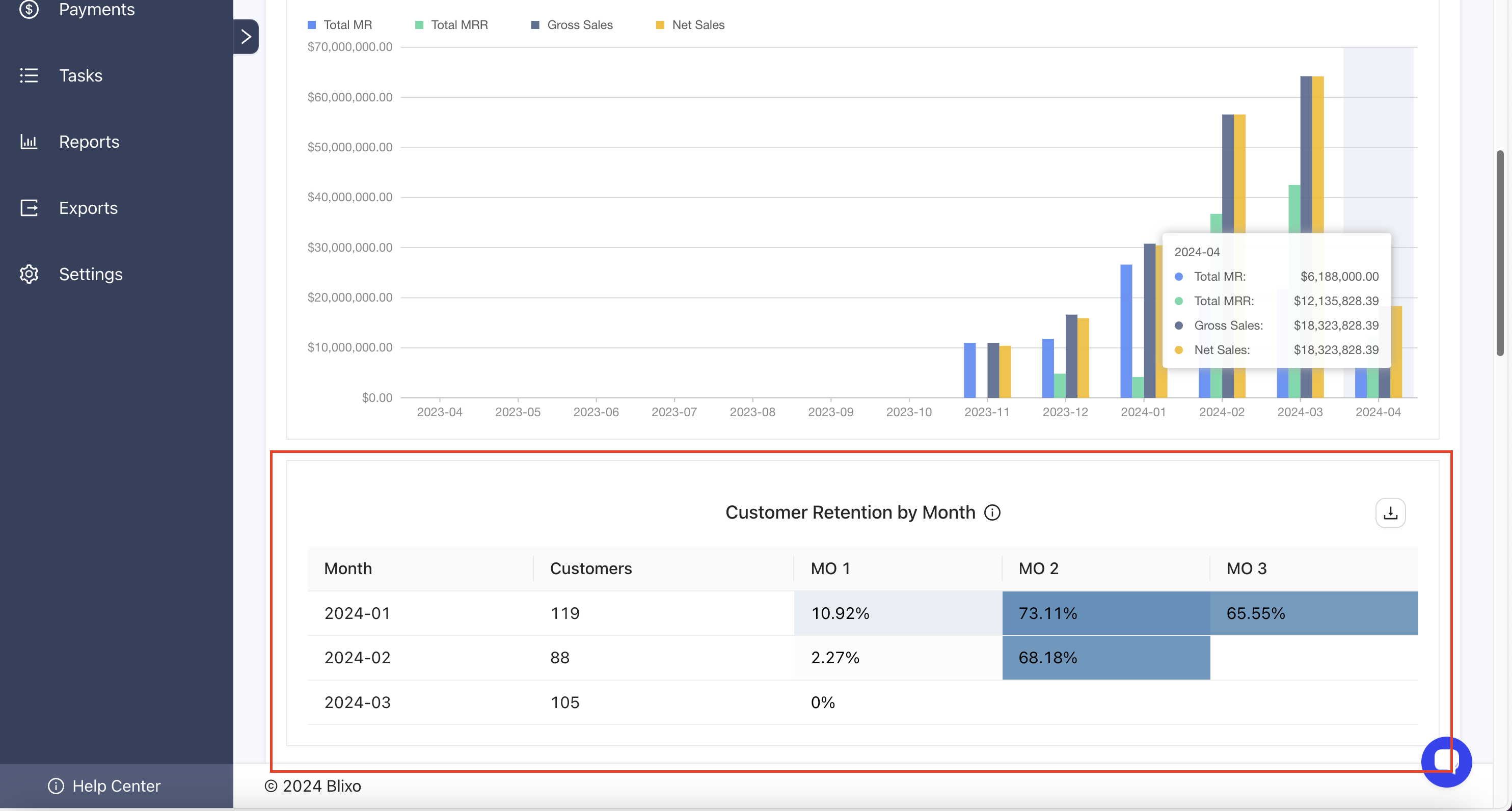

Customer Retention

Customer retention is a vital aspect of any successful business strategy. It refers to the ability of a company to retain its existing customers over a certain period of time, rather than losing them to competitors or other factors. In today’s competitive market landscape, where acquiring new customers can be costly and challenging, retaining existing customers becomes even more crucial. This documentation aims to provide insights, strategies, and best practices to help businesses effectively retain their customers and foster long-term relationships.

Tracking and measuring customer retention metrics is essential for evaluating the effectiveness of retention efforts and identifying areas for improvement. Key metrics to consider include:

-

Customer Churn Rate: The percentage of customers who stop using your product or service over a specific period.

-

Customer Lifetime Value (CLV): The total revenue a customer is expected to generate over their entire relationship with your business.

-

Repeat Purchase Rate: The percentage of customers who make more than one purchase from your business within a certain timeframe.

-

Net Promoter Score (NPS): A metric that measures customer loyalty and satisfaction by asking customers how likely they are to recommend your business to others.

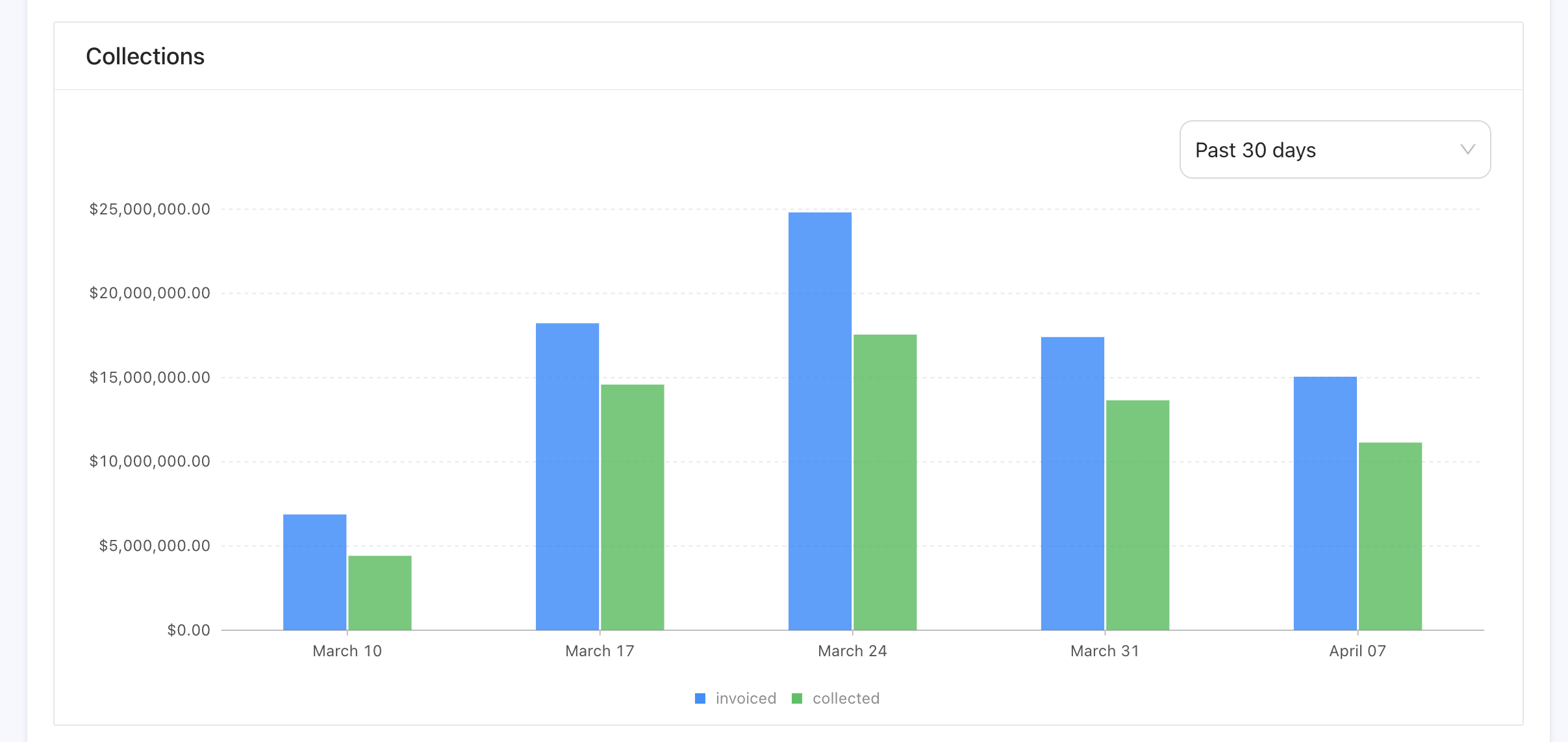

Collections

The Collections Dashboard is a centralized hub within our platform tailored to streamline and optimize your collections management processes. It offers a user-friendly interface that empowers you to monitor, track, and manage collections-related activities efficiently. From tracking outstanding invoices to analyzing payment trends, the dashboard provides actionable insights to enhance your collection strategies and drive financial success.

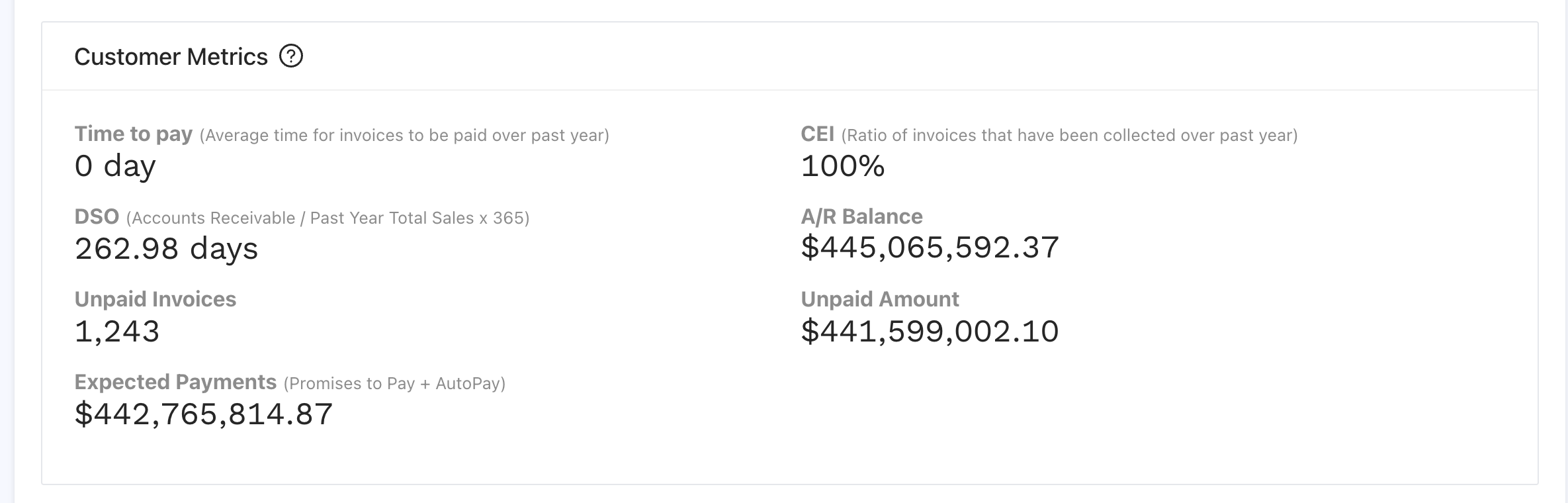

Customer Metrics

Customer metrics refer to the quantitative measures used to evaluate various aspects of customer behavior, satisfaction, and engagement. These metrics provide valuable insights into how customers interact with products, services, and the overall brand. By analyzing customer metrics, businesses can make data-driven decisions to improve their offerings and foster stronger customer relationships.

- DSO (Accounts Receivable / Past Year Total Sales x 365)

- Time to pay (Average time for invoices to be paid over past year)

- Unpaid Invoices

- Expected Payments (Promises to Pay + AutoPay)

- CEI (Ratio of invoices that have been collected over past year)

- A/R Balance

- Unpaid Amount

- Activity

Customer metrics play a pivotal role in understanding customer behavior, preferences, and satisfaction levels. By leveraging the insights gained from these metrics, businesses can make data-driven decisions to improve their offerings, enhance customer experiences, and drive long-term success. Embrace the power of customer metrics to unlock new opportunities for growth and innovation in your business.

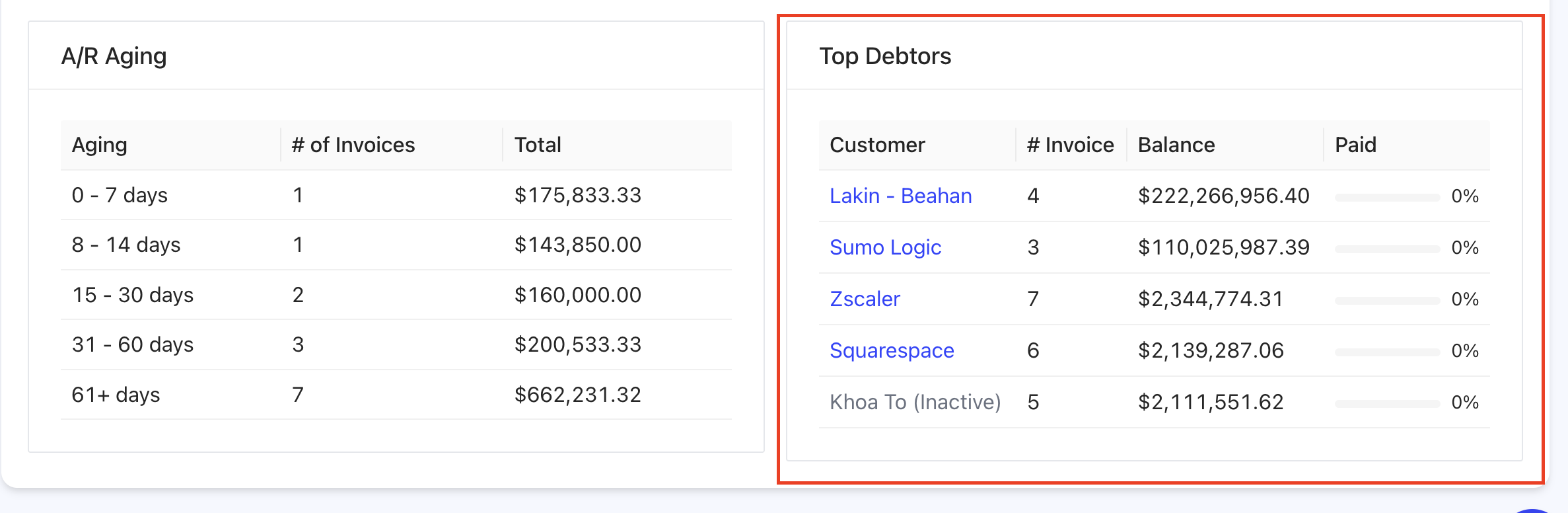

A/R Aging

A/R Aging, or Accounts Receivable Aging, is a financial analysis tool used to track and manage outstanding invoices and payments from customers. It provides valuable insights into the aging of receivables, categorizing them based on the length of time they have been outstanding. By organizing receivables into aging buckets, businesses can assess the health of their accounts receivable and take appropriate actions to improve cash flow.

A/R Aging is a fundamental tool for managing accounts receivable effectively and optimizing cash flow for businesses. By leveraging Blixo’s comprehensive features and adhering to best practices, users can gain actionable insights, improve collections efficiency, and maintain financial stability. Empower your organization with A/R Aging within Blixo and unlock the full potential of your receivables management strategy.

Top Debtors

The “Top Debtors” feature is a powerful tool designed to streamline debt management processes and enhance financial control within your organization. By leveraging its capabilities, you can gain valuable insights, mitigate risks, and drive efficient debt recovery efforts. Stay informed, take action, and optimize your debt management strategies with confidence.

-

Improved Financial Visibility: Gain insights into the most significant outstanding debts within your system, facilitating better financial planning and forecasting.

-

Enhanced Risk Management: Identify potential risks associated with high-value debts and implement mitigation strategies to protect your organization’s financial health.

-

Streamlined Debt Recovery: Take proactive measures to recover outstanding balances by prioritizing communication and engagement with top debtors.