Harnessing the Power of Blixo: The Ultimate Dashboard for Monitoring Import-Export Business Financial KPIs

In the dynamic world of international trade, financial agility is key to success. Blixo emerges as a cutting-edge solution, offering an ultimate dashboard designed for monitoring import-export financial Key Performance Indicators (KPIs). This comprehensive tool provides enterprises with real-time insights and historical data analysis, empowering them to make informed decisions, optimize financial health, and enhance customer satisfaction. The platform’s versatility in tracking a wide array of metrics, from revenue growth to customer retention, positions Blixo as an indispensable asset for businesses striving to thrive in the global market.

Key Takeaways

- Blixo’s dashboard offers a centralized solution for tracking essential financial KPIs, facilitating strategic decision-making in the import-export sector.

- Real-time data and historical analysis features enable businesses to monitor trends, forecast growth, and adjust strategies promptly.

- Customizable views and analytics help in managing cash flow, unpaid invoices, and accounts receivable, improving overall financial health.

- Blixo’s reporting features support forecasting and risk mitigation by identifying top debtors and optimizing collection strategies.

- Enhancing customer retention and satisfaction is made possible through Blixo’s insights into retention rates, subscription trends, and customer experience.

Understanding Blixo’s Financial KPI Dashboard

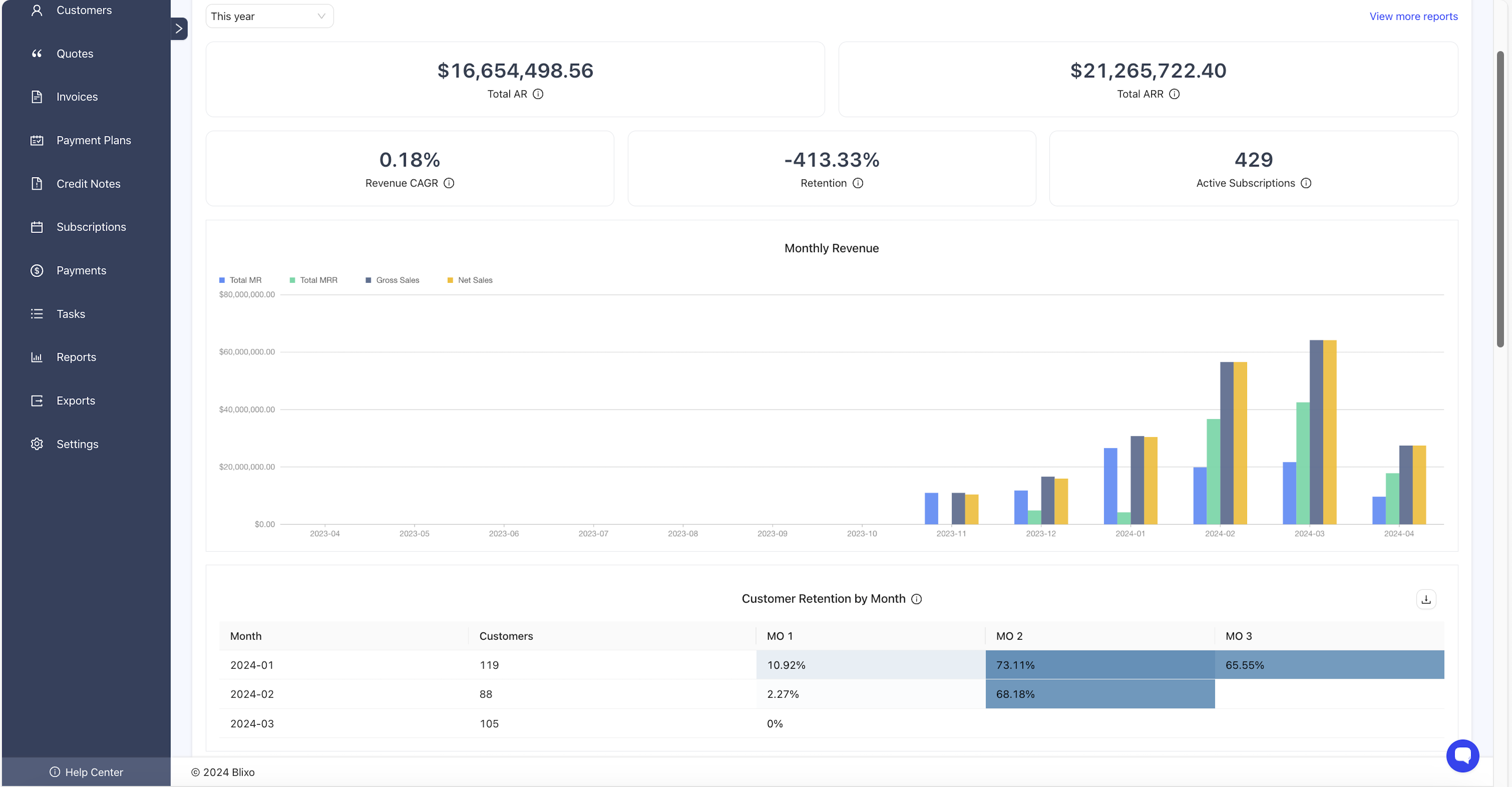

Explore more about Blixo KPI Dashboard here

Navigating the Dashboard Interface

Mastering the Blixo dashboard interface is the first step to unlocking the full potential of your financial KPI monitoring. Effortlessly navigate through various modules with intuitive controls and a user-friendly layout. The dashboard is designed to provide a seamless experience, whether you’re analyzing real-time data or diving into historical trends.

- Home: Overview of key metrics at a glance

- Revenue: Detailed revenue streams and growth indicators

- Customers: Insights into customer behavior and sales performance

- Collections: Status of accounts receivable and invoice aging

Customizing KPI Views for Your Business

Blixo’s dashboard is not a one-size-fits-all solution; it’s a dynamic platform that allows for tailored KPI views to match your unique business needs. By selecting the metrics that resonate most with your company’s financial health, you create a personalized experience that highlights the most critical data at a glance.

- Identify the key financial metrics relevant to your import-export operations.

- Prioritize the KPIs based on their impact on your business decisions.

- Arrange the dashboard to reflect the hierarchy of your chosen metrics.

The customization process is integral to ensuring that the dashboard serves as a true extension of your business strategy.

Remember, the goal is to streamline your monitoring process, making it both efficient and insightful. With Blixo, you can adjust the granularity of the data, set up alerts for specific thresholds, and even integrate external data sources to enrich your KPI analysis.

Real-Time Data and Historical Analysis

Blixo’s dashboard is engineered to provide a seamless blend of real-time data and historical analysis, enabling businesses to make informed decisions swiftly. Real-time tracking ensures that you’re always aware of the current financial health of your import-export operations, while historical data offers insights into trends and patterns over time.

- Real-Time Data: Immediate visibility into financial metrics

- Historical Trends: Analysis of past performance to forecast future outcomes

- Comparative Analysis: Year-over-year or period-over-period financial comparisons

By leveraging both real-time and historical data, businesses can detect anomalies, predict cash flow issues, and adjust strategies proactively.

The integration of these two data types allows for a comprehensive understanding of your financial trajectory. With Blixo, you can easily switch between snapshots of current financial standings and detailed reports of past activities, ensuring that every decision is backed by robust data.

Key Performance Indicators for Import-Export Success

Tracking Revenue and Growth Metrics

Understanding the financial health of an import-export business hinges on the ability to track and analyze key revenue and growth metrics effectively. Blixo’s dashboard provides a comprehensive view of these critical indicators, enabling businesses to monitor their financial performance with precision.

Key metrics include net revenue, year-over-year growth, and profit margins. These figures are essential for assessing the company’s current market position and forecasting future performance. Blixo simplifies this process by offering a clear and customizable interface that highlights trends and potential areas of concern.

By leveraging Blixo’s dashboard, businesses can gain actionable insights into their financial trajectory, ensuring that strategic decisions are data-driven and aligned with long-term objectives.

Here’s a snapshot of the typical revenue and growth metrics monitored on Blixo:

| Metric | Description | Current Value | Target |

|---|---|---|---|

| Net Revenue | Total income from sales | $1.2M | $1.5M |

| YoY Growth | Year-over-year revenue increase | 20% | 25% |

| Profit Margin | Net income as a percentage of revenue | 15% | 18% |

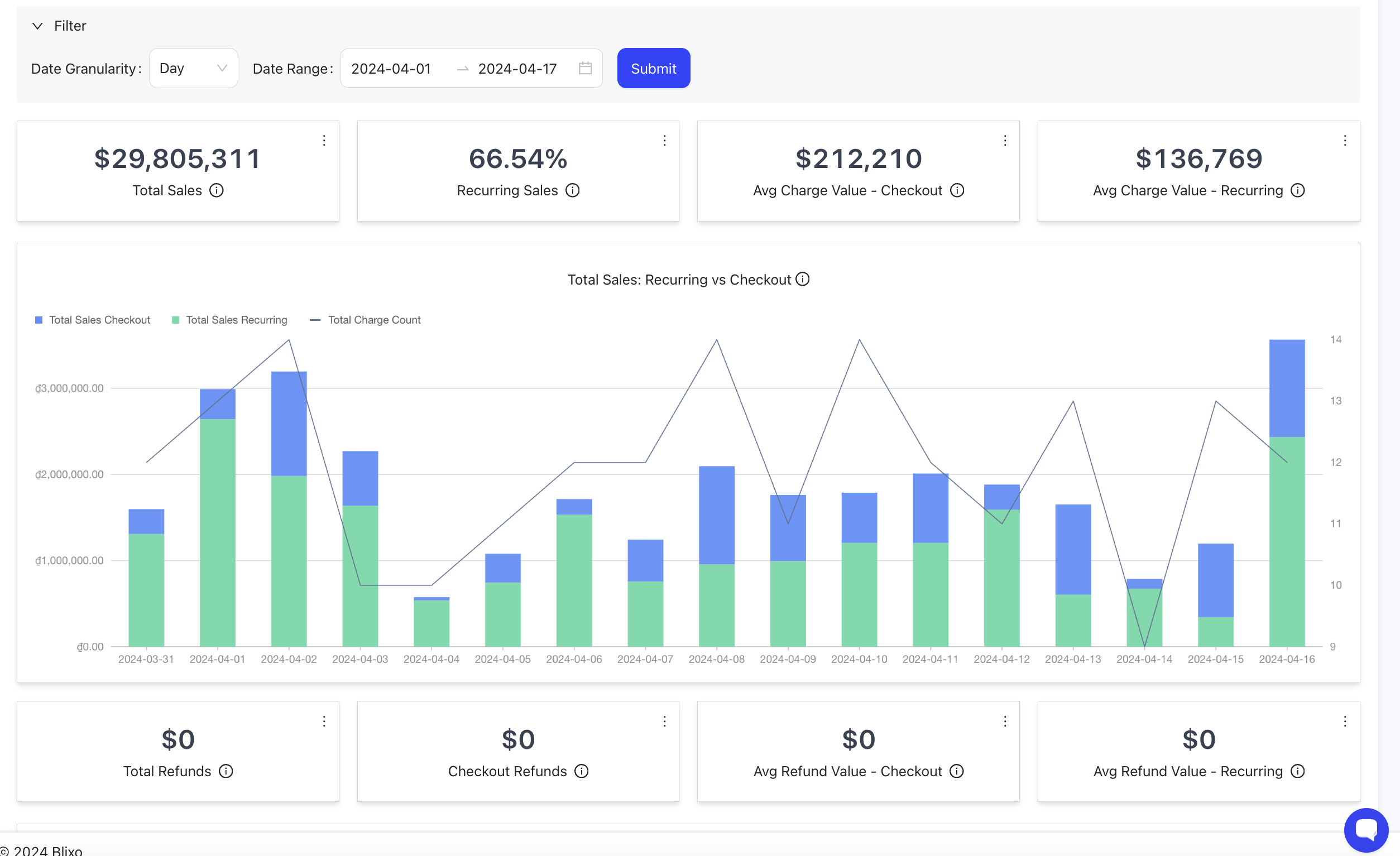

Monitoring Customer and Sales Performance

In the dynamic realm of import-export businesses, monitoring customer and sales performance is crucial for sustaining growth and profitability. Blixo’s dashboard provides a comprehensive view of sales trends and customer behaviors, enabling businesses to make data-driven decisions.

- Sales Volume: Track the number of transactions over a given period.

- Customer Acquisition Cost (CAC): Measure the cost effectiveness of marketing campaigns.

- Customer Lifetime Value (CLV): Understand the long-term value of customers.

- Conversion Rates: Analyze the percentage of leads that turn into customers.

By leveraging these metrics, companies can identify areas for improvement and strategize accordingly to enhance their market position.

Additionally, Blixo’s KPI dashboard allows for the segmentation of data, offering insights into different markets and customer groups. This level of detail is instrumental in tailoring strategies to specific segments, ultimately leading to better customer engagement and increased sales performance.

Analyzing Accounts Receivable and Collections

In the realm of import-export businesses, maintaining a healthy cash flow is paramount. Blixo’s dashboard excels in providing a comprehensive view of accounts receivable and collections. It allows for a meticulous analysis of customer payments, advances, credit notes, and sales returns, all from a single interface.

By leveraging the Accounts Receivable Dashboard, companies can pinpoint areas that require immediate attention and make informed decisions to enhance their financial health.

The dashboard’s intuitive design enables users to quickly identify outstanding invoices and assess the efficiency of their collections process. Here’s a snapshot of the key metrics available:

| Metric | Description |

|---|---|

| Total Outstanding | Total amount pending collection |

| Average Days to Pay | Average time taken by customers to pay invoices |

| Collection Effectiveness Index (CEI) | Measures the quality of collections over a period |

These metrics serve as vital indicators of a company’s liquidity and are essential for strategic planning. By monitoring these KPIs, businesses can effectively manage their cash flow and ensure operational continuity.

Optimizing Financial Health with Blixo’s Analytics

Improving Cash Flow with DSO and Time to Pay Insights

Cash flow is the lifeblood of any import-export business, and Blixo’s dashboard provides critical insights into two key metrics: Days Sales Outstanding (DSO) and Time to Pay. By closely monitoring DSO, businesses can understand the average number of days it takes to collect payment after a sale, which is crucial for managing liquidity.

Blixo’s analytics enable companies to track Time to Pay trends, helping them identify delays in payments and take proactive measures to encourage faster settlements.

To optimize cash flow, consider the following steps:

- Evaluate your current DSO and set realistic improvement goals.

- Analyze customer payment patterns to forecast future cash flow.

- Implement strategies to incentivize early payments, such as discounts or favorable payment terms.

By leveraging these insights, businesses can streamline their collections process, reduce the time capital is tied up in receivables, and ultimately enhance their financial health.

Managing Unpaid Invoices and A/R Aging

Effectively managing unpaid invoices and accounts receivable (A/R) aging is crucial for maintaining a healthy cash flow. Blixo’s dashboard provides a comprehensive view of outstanding invoices, allowing businesses to prioritize their collection efforts based on the age of the receivables.

- Gather unpaid invoices: Compile all outstanding invoices to assess the total amount due.

- Calculate days past due: Determine the age of each invoice to identify overdue payments and prioritize follow-up actions.

By systematically addressing A/R aging, companies can prevent cash flow disruptions and maintain a steady revenue stream.

Blixo also enables users to set up alerts for invoices reaching critical aging thresholds, ensuring timely intervention. The platform’s analytics can help identify patterns in payment delays, offering insights for improving future invoicing practices.

Leveraging CEI for Better Collection Strategies

The Collections Effectiveness Index (CEI) is a pivotal metric in assessing the efficiency of a company’s collections efforts. By analyzing the percentage of receivables a company has successfully collected in a given period, businesses can pinpoint areas for improvement in their collections process. Blixo’s dashboard allows for a detailed CEI analysis, enabling users to make informed decisions to enhance their collection strategies.

To effectively leverage CEI, consider the following steps:

- Review and adjust your credit and collections policies as needed.

- Optimize your invoicing practices to ensure clarity and promptness.

- Maintain open and clear communication with customers regarding their obligations.

By focusing on these areas, companies can significantly improve their CEI, leading to a more robust financial position and better cash flow management.

Understanding the nuances of CEI can transform how a business approaches debt collection. With Blixo’s insights, companies are equipped to refine their strategies, ultimately improving their bottom line.

Strategic Decision-Making with Blixo’s Reporting Features

Forecasting with Expected Payments and Activity Metrics

Blixo’s dashboard empowers businesses to anticipate future cash flows by analyzing expected payments and activity metrics. Forecasting is crucial for maintaining a healthy cash flow, and Blixo’s tools are designed to provide a clear picture of what’s to come. By leveraging predictive analytics, companies can prepare for various financial scenarios, ensuring they are never caught off guard.

- Review past payment trends

- Analyze current open invoices

- Predict future cash flow based on historical data

With Blixo, you gain the ability to not only track what has happened but also to project future financial health with confidence.

The dashboard’s intuitive design allows for easy identification of patterns and potential issues. This proactive approach to financial management is what sets Blixo apart, making it an indispensable tool for import-export businesses.

Identifying Top Debtors and Mitigating Risks

Identifying top debtors is crucial for maintaining a healthy cash flow and mitigating financial risks. Blixo’s dashboard provides a comprehensive view of debtor accounts, enabling businesses to prioritize their follow-up actions and tailor their risk management strategies.

- Review debtor lists to pinpoint accounts with high outstanding balances.

- Analyze payment patterns to forecast potential delinquencies.

- Implement credit limits and terms adjustments based on debtor risk profiles.

By proactively managing debtor relationships, companies can reduce the incidence of bad debt and strengthen their financial resilience. Blixo’s tools assist in creating a dynamic approach to debtor management, ensuring that high-risk accounts receive the attention they need before they impact the business’s bottom line.

Effective risk mitigation involves not just identifying the top debtors but also understanding the underlying causes of delayed payments. Blixo’s analytics can reveal insights into market trends, customer behaviors, and economic factors that may influence payment practices, allowing for more informed decision-making and strategy development.

Utilizing Custom Reports for Informed Business Planning

In the dynamic world of import-export, the ability to generate custom reports is crucial for staying ahead. Blixo’s dashboard empowers businesses to tailor their financial reporting to their specific needs, ensuring that every decision is backed by accurate and relevant data.

With Blixo, you can easily modify report parameters to focus on the metrics that matter most to your business. This flexibility allows for a deeper understanding of financial health and more strategic planning.

Creating custom reports in Blixo is straightforward and intuitive. Here’s a simple process to get started:

- Navigate to the ‘Reports’ section of the dashboard.

- Select the ‘Custom reports’ tab to access your saved reports.

- Find the report you wish to edit and choose ‘Edit’ from the Action column.

- Adjust the report settings to match your business objectives and set email schedules for regular updates.

By harnessing the power of Blixo’s custom reporting features, businesses can craft a narrative that aligns with their strategic goals, making it easier to communicate progress and areas for improvement to stakeholders.

Enhancing Customer Retention and Satisfaction

Evaluating Retention Rates and Subscription Trends

Understanding customer retention is pivotal for the import-export industry, where long-term relationships translate into sustained revenue. Blixo’s dashboard provides a clear view of retention rates and subscription trends, enabling businesses to identify patterns and act accordingly.

Retention cohort analysis is a powerful feature within Blixo that allows for a nuanced understanding of customer loyalty. It groups users based on their initial interaction with your service, rather than the total user base, offering a more accurate measure of retention over time.

By monitoring these metrics, companies can pinpoint the exact moment when customers decide to continue or cease their subscriptions, which is crucial for improving retention strategies.

Here’s a simplified view of how retention data might be presented:

| Cohort | Initial Users | Retained After 1 Month | Retained After 6 Month |

|---|---|---|---|

| Jan ‘23 | 100s | 85 | 65 |

| Feb ‘23 | 120 | 90 | 70 |

| Mar ‘23 | 110 | 80 | 60 |

This table helps businesses quickly assess the effectiveness of their customer engagement and retention initiatives over time.

Implementing Targeted Customer Retention Strategies

To bolster customer loyalty, Blixo’s dashboard enables businesses to implement targeted customer retention strategies that are data-driven and tailored to specific customer segments. By analyzing customer behavior and feedback, companies can develop personalized engagement plans that resonate with their audience.

- Identify high-value customers and understand their needs

- Segment customers based on purchasing patterns

- Tailor marketing and support to match customer preferences

By proactively addressing the concerns and preferences of different customer groups, businesses can create a more personalized and effective retention strategy.

Regularly reviewing customer satisfaction metrics and adjusting strategies accordingly ensures that efforts to keep customers engaged are always evolving. This dynamic approach to customer retention is crucial for maintaining a competitive edge in the import-export financial sector.

Using Blixo’s Insights to Enhance Customer Experience

Leveraging Blixo’s insights can significantly improve the customer experience by providing a deep understanding of customer interactions and satisfaction levels. By analyzing metrics such as user engagement, businesses can pinpoint areas that need improvement and implement targeted strategies to boost customer satisfaction.

- Evaluate customer feedback and satisfaction scores

- Monitor support ticket trends and resolution times

- Track user activity and engagement patterns

By consistently monitoring and responding to customer behavior, companies can create a more personalized and satisfying customer journey.

Understanding the nuances of customer behavior is crucial for maintaining a competitive edge. Blixo’s dashboard allows for a granular look at the customer lifecycle, helping businesses to refine their customer service approach and foster loyalty.

Conclusion

In conclusion, Blixo stands out as the ultimate dashboard for businesses engaged in import-export activities, offering a comprehensive suite of financial KPIs to monitor performance. With the ability to track metrics such as Total Monthly Revenue, Retention Rate, and A/R Aging, Blixo provides a clear and actionable overview of a company’s financial health. The platform’s user-friendly interface and real-time data analysis empower decision-makers to make informed choices, optimize cash flow, and drive growth. By leveraging Blixo’s robust features, enterprises can stay ahead of the curve, ensuring they remain competitive in the dynamic global market.

Frequently Asked Questions

What financial KPIs can I monitor with Blixo’s dashboard?

Blixo’s dashboard allows you to monitor a wide range of financial KPIs including Total Monthly Revenue, Monthly Recurring Revenue, Revenue Growth Rate, Retention Rate, Active Subscriptions, Gross and Net Sales, Collections, Customer Metrics, Days Sales Outstanding (DSO), Time to Pay, Unpaid Invoices, Expected Payments, Collection Effectiveness Index (CEI), Accounts Receivable Balance, Unpaid Amount, Activity Metrics, Accounts Receivable Aging, and identification of Top Debtors.

Can I customize the KPI views on Blixo to fit my business needs?

Yes, Blixo offers customizable KPI views to align with your specific business requirements. You can tailor the dashboard to highlight the metrics that are most relevant to your import-export business.

Does Blixo provide real-time data for financial monitoring?

Blixo provides real-time data updates, allowing you to monitor your financial performance as it happens. This enables you to make timely decisions based on the latest information.

How can Blixo’s analytics help improve my company’s cash flow?

Blixo’s analytics provide insights into Days Sales Outstanding (DSO) and Time to Pay, which can help you identify bottlenecks in your payment processes and improve cash flow by strategizing on how to reduce the time it takes for invoices to be paid.

What reporting features does Blixo offer for strategic decision-making?

Blixo offers a range of reporting features including forecasting expected payments, activity metrics, identifying top debtors, and custom report generation, all of which can inform your strategic business planning and risk mitigation.

How does Blixo enhance customer retention and satisfaction?

Blixo helps you evaluate retention rates and subscription trends, implement targeted customer retention strategies, and use insights gained from the platform to enhance the customer experience and satisfaction, ultimately leading to higher retention.