Behind Closed Doors: Exposing the Strategies to Predict Payment Delays and Attain Success

Preliminary Insights

Technology enterprises stand as vanguards of innovation, dedicating substantial resources to market analysis, R&D, and strategic market penetration, aimed at maintaining a competitive edge.

Cash flow, a fundamental aspect in this dynamic environment, plays a pivotal role in sustaining expansion, managing operational expenses, and navigating market fluctuations. Nonetheless, proficient cash flow management poses a significant challenge for numerous B2B tech firms, presenting a critical domain for expertise acquisition.

The primary obstacle arises from Delayed payments, which this discourse delves into, dissecting their ramifications and exploring the proactive measures adopted by leading tech conglomerates to mitigate and pre-empt customer payment behaviors.

An Expert Outlook

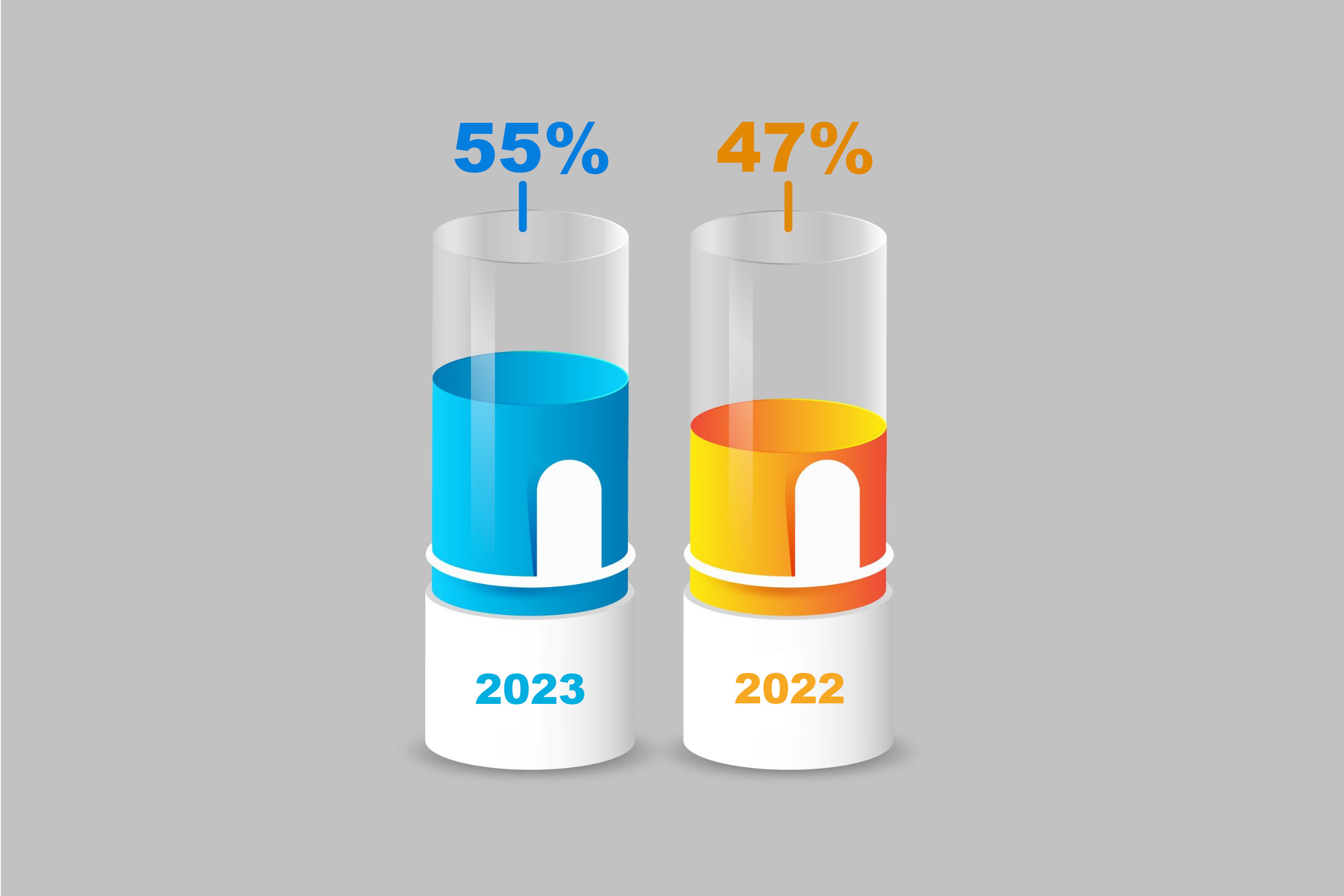

The payment delay arena emerges as a convoluted terrain, fraught with various intricacies. According to data extracted from a survey orchestrated by Atradius, a discernible pattern emerges: B2B payments within the United States experienced a significant upswing in delays during 2023, soaring to 55%, representing an 18% surge from the preceding year’s tally of 47%.

The alarming statistic reveals a concerning trend: bad debt write-offs have soared to over 9%, representing a stark 50% uptick since 2022. It’s imperative to grasp that payment delays constitute more than just administrative hurdles; they engender significant ramifications for cash inflow management and daily business functions.

A Comprehensive Analysis of Root Causes

Insights from Financial Advisors

The root cause behind payment delays frequently lies in the financial instability of clients. During economic downturns or ineffective financial management, organizations seek support to fulfill their payment responsibilities.

According to recent findings from a comprehensive LinkedIn study, there’s a discernible trend indicating that clients are prone to postponing or scaling down payment frequencies amidst a cash flow constraint. Concurrently, suppliers are intensifying their call for expedited payments or implementing penalties for delayed payments, thereby engendering a conundrum with dual implications.

The latest findings from Atradius highlight a concerning trend: economic downturns coincide with a noticeable uptick in payment delays, exposing businesses to the financial vulnerabilities of their clientele. Moreover, the resultant ripple effects amplify the cash flow challenges experienced by suppliers, shedding light on the intricacies of contemporary business interdependencies.

Navigating Client Payment Procedures: A Legal Perspective

The findings disseminated by Paystream Advisor shed light on a significant aspect: a staggering 50% of enterprises grapple with notable delays ranging from 10 to 25 days solely in the process of invoice approval. This revelation bears considerable weight, particularly in juxtaposition with the standard payment terms stipulated by companies in the year 2023, currently fixed at 35 days.

The temporal divergence between the approval duration of invoices and the adherence to stipulated payment terms elucidates a critical inefficiency within the client’s accounts payable mechanism. These delays during the preliminary approval phase absorb a substantial fraction of the payment timeframe, thereby reducing the scope for streamlined payment validation and receivables consolidation.

The constriction at this juncture significantly burdens the company’s liquidity, as the elongated duration for receipt of funds surpasses the stipulated payment timeframe. Furthermore, this delay in the authorization procedure intimates inefficiencies or intricacies within internal protocols, spanning from excessively bureaucratic authorization structures to insufficient utilization of technological resources in invoice management.

Remedying Inefficiencies in Invoicing and Collections

Invoicing and collections processes are marred by inefficiencies that significantly impact payment timelines. These inefficiencies are frequently rooted in outdated or manual systems susceptible to errors, lack of well-defined payment terms, or ineffective communication channels between creditor and debtor entities.

Managing Invoice and Contract Disputes

Instances of discord pertaining to the specifics delineated within invoices and contractual agreements stand out as a recurring challenge within organizational frameworks, necessitating proactive measures to ensure adherence to established protocols.

Challenges may arise from variations in product/service specifications, misinterpretation of contractual obligations, or discrepancies in pricing structures.

Addressing these conflicts necessitates a strategic approach, emphasizing effective communication and negotiation tactics to foster mutually beneficial outcomes. Referenced in the Payment Practices Barometer report, the prevalence of contract-related disputes significantly impacts payment cycles, prompting businesses to undertake multifaceted negotiations to secure owed payments.

Fueling Business Expansion and Success

This occurrence arises when commercial entities opt to grant credit facilities to their clientele, enabling them to procure goods or services on credit terms and settle the dues at a subsequent date, typically delineated by payment conditions like NET 30, 45, or 60.

The data gleaned from the Barometer report indicates a prevailing sentiment among businesses, with a consensus emerging that a surge in demand and sales is expected in the forthcoming years, particularly in 2024 and beyond. This finding underscores the need for further scholarly inquiry into the underlying factors driving this anticipated growth trajectory.

Credit offerings serve as a potent tool in amplifying consumer purchasing power and bolstering sales performance. However, they also pose inherent risks, notably pertaining to payment delays. In light of this, a strategic adjustment in credit terms has been executed, transitioning from a 42-day grace period in 2022 to a more expedited 35-day window in 2023. This strategic recalibration aims to optimize revenue streams while concurrently enhancing payment efficiency, thereby fortifying the brand’s competitive positioning and customer-centric ethos.

The Art of Collecting Outstanding Invoices

Delayed payments necessitate the allocation of substantial time, monetary resources, and workforce efforts by companies towards the pursuit of outstanding invoices, impacting liquidity management and financial stability.

Paired with manual AR protocols, the outcome is concerning: Businesses relying on manual methods for collections management encounter significant operational costs.

This not only leads to a loss of focus on essential tasks among our employees but also generates additional costs linked to subsequent investigations and legal measures, thus impacting our financial bottom line.

Strengthening Internal Credit Control Processes

Amidst the challenges posed by payment delays, companies are urged to optimize their internal credit control processes. This encompasses conducting thorough credit risk assessments, implementing robust receivables monitoring systems, and enforcing stricter credit terms. By integrating these measures into their business strategies, organizations can enhance their financial stability, foster stronger customer relationships, and position themselves for long-term success in competitive markets.

The adoption of such measures, albeit indispensable, mandates investment in training initiatives and technological advancements, inevitably escalating operational expenditures. Nevertheless, expeditious credit control mechanisms can substantially attenuate the perils associated with payment delays, thereby fortifying the company’s ability to oversee its credit liabilities.

Optimizing Vendor Relationships Through Payment Timeframe Adjustment

The strategic choice to delay payments inevitably affects the settlement schedule with suppliers. Although ostensibly offering a temporary reprieve in managing cash flows, this approach introduces tension into vendor relations and amplifies the expenses associated with procured goods or services, primarily due to penalties incurred from delayed payments or the forfeiture of early payment incentives. Moreover, it initiates a chain reaction, permeating through the intricate web of the supply chain, thereby impacting an array of interconnected businesses.

Pursuing External Financing Opportunities

An exploration into corporate financing strategies reveals a prevalent reliance on external funding mechanisms such as trade credit, bank loans, equity infusion, and invoice factoring, aimed at ameliorating the impacts of payment delays. Notably, empirical data from the United States indicates that trade credit facilities are favored by 60% of enterprises, while 52% resort to bank financing solutions to bolster their financial resilience.

The strategic infusion of external funding is instrumental in mitigating operational liquidity constraints; however, it simultaneously introduces incremental interest outlays. Sustained reliance on external financing may exacerbate the company’s debt obligations, consequently compromising its creditworthiness and future financial flexibility.

Addressing Delays in Bill and Staff Payments

Failure to promptly settle payments can precipitate a cascading effect within commercial operations, impeding the timely disbursement of crucial financial obligations such as essential bills and employee compensations. Such procrastination in fulfilling financial commitments may engender service interruptions, incurring supplementary charges, or impairing the organization’s credit standing. Moreover, deferring employee salary disbursements can evoke discontent among the workforce, potentially fostering an environment conducive to turnover, thereby exacerbating the operational hurdles confronting the company.

Leveraging Predictive Strategies for Enhanced Financial Resilience

In light of escalating payment delays, companies are increasingly embracing predictive approaches that integrate data analytics, technological advancements, and enhanced communication channels. These strategies offer a robust framework for adeptly addressing the complexities associated with delayed payments.

The proactive management of accounts receivable processes empowers firms to anticipate and navigate payment delays, underscoring the significance of strategic financial planning in sustaining organizational resilience and viability.

-

The Integration of AR Data for Discerning Payment Behavior Patterns: Through advanced data analytics, organizations can effectively scrutinize augmented reality data to unveil intricate payment behavior trends. This capability facilitates the identification of late-paying clientele, discerning peak periods of payment delays, and identifying invoices vulnerable to non-payment.

-

Employing Machine Learning Models for Payment Delay Prediction: These models utilize intricate algorithms to analyze diverse data inputs such as client payment histories, economic indicators, and transactional attributes, facilitating accurate predictions of payment delays for each invoice. Through the application of predictive analytics, businesses can streamline collection processes and devise adaptive credit terms to proactively address the risk of future payment delays.

-

Accounting and Auditing Perspective: Creditworthiness Appraisal: A Financial Imperative: In the realm of accounting and auditing, the meticulous evaluation of credit risk underscores the essence of financial prudence. Through a diligent analysis spanning client credit histories, economic health indicators, and market dynamics, practitioners glean invaluable insights into the financial viability of clientele. This evaluative exercise lays the groundwork for sound financial decision-making, guiding clients in establishing prudent credit terms and limits to mitigate financial risks effectively.

-

Integrating Real-Time Risk Assessment for Adaptive Credit Limits: The incorporation of dynamic credit limits, predicated on real-time evaluations of client creditworthiness, introduces a fluidic paradigm to credit management. With shifts in a client’s financial landscape, their credit ceiling adjusts correspondingly, thereby mitigating the hazards tied to payment delays. This methodology necessitates ongoing scrutiny of clients’ financial viability and prompt recalibrations of credit frameworks as exigencies arise.

-

Building robust client relationships is essential for gaining insights into their payment processes. By leveraging open communication channels, businesses can identify potential obstacles within the client’s payment cycle, thus preempting any delays. This understanding facilitates the development of customized payment solutions that align with the client’s preferences, optimizing efficiency and reducing payment friction.

-

Mitigating financial risks necessitates proactive interaction with clients displaying early indicators of payment delays. This proactive endeavor entails initiating discussions well before invoice deadlines, identifying potential impediments to timely payments, and devising pragmatic solutions such as phased payment arrangements or refinements to payment protocols. Embracing this proactive methodology not only averts potential payment hiccups but also fosters robust project management practices and sustained client satisfaction.

Organizational Best Practices

To address payment delays, organizations must adopt multifaceted strategies aimed at sustaining cash flow and mitigating adverse impacts. Key components include the establishment of cross-functional teams and a dedicated focus on training and development efforts. By leveraging these strategic approaches, businesses can effectively manage delays, ensuring financial stability and fortifying customer loyalty.

The Power of Cross-Functional Teams

The establishment of cross-functional teams represents a critical mechanism for mitigating payment delays. These teams converge professionals from disparate fields such as finance, sales, and customer service. Employing a multidisciplinary approach, these teams employ advanced problem-solving techniques to address payment delays comprehensively, thus enhancing organizational efficiency and resilience.

-

Elevating Communication Standards: Cross-functional teams play a pivotal role in optimizing communication across the organizational landscape. This guarantees a cohesive comprehension among departments regarding the criticality of prompt payments and their direct impact on minimizing operational setbacks.

-

Diagnosing Core Issues: Employing a multifaceted approach, these seasoned teams diligently dissect the underlying causes of payment delays. Through rigorous analysis of organizational structures and client interactions, they prescribe strategic remedies to mitigate risks and fortify operational efficiency.

-

Developing strategic solutions is critical in the management of payment delays. By leveraging a variety of perspectives within cross-functional teams, innovative strategies can be formulated to address and prevent such occurrences. These may entail the restructuring of payment terms, optimization of billing workflows, and the implementation of comprehensive customer education programs regarding payment expectations.

- The expedited execution of process ameliorations is facilitated through cross-functional collaboration. Teams adeptly discern inefficiencies in payment protocols, effecting requisite modifications to enhance operational efficiency and streamline workflows.

Strategies for Training and Development

Recognizing the significance of investing in training and development is paramount, as it plays a crucial role in equipping team members with the essential skills and knowledge necessary for proficiently mitigating the impacts of payment delays.

-

Routine training sessions serve as a cornerstone in fortifying the negotiation, communication, and problem-solving capabilities of our personnel. These indispensable competencies are paramount in addressing payment delays judiciously and expeditiously.

-

Within the ever-fluctuating financial landscape, remaining updated is paramount. Training programs serve as a conduit for employees to assimilate the latest best practices and technological strides in payment processing and accounts receivable management, ensuring operational efficacy and competence.

-

Fostering a proactive organizational culture entails implementing strategic developmental programs aimed at instilling a forward-thinking mindset within employees. By doing so, businesses empower their workforce to preemptively identify and mitigate payment delays, effectively managing risks before they burgeon into significant issues.

-

The significance of honing customer service skills, especially in mitigating payment delays, is paramount. Adequate training facilitates adept handling of intricate dialogues with a blend of empathy and professionalism, thus preserving constructive customer rapport amidst testing circumstances.

Strategic Integration of Technology to Combat Payment Delays

In tandem with operational enhancements, enterprises can leverage accounts receivable software solutions that offer augmented automation, visibility, and collaboration functionalities.

Sophisticated AR process automation surpasses the traditional scope of invoicing and payment reminders. State-of-the-art software solutions equip businesses with predictive analytics capabilities, enabling proactive identification and resolution of payment delays to optimize financial performance.

-

Anticipated Payment Projection: Accounts receivable software offers the functionality to predict the payment date of invoices by leveraging historical payment behavior and relevant customer demographic attributes such as industry segmentation, regional distribution, or national delineations. This feature enables finance teams to identify accounts with higher risk profiles and forecast invoice payment dates with enhanced accuracy.

-

AR solutions offer a strategic advantage by incorporating account health scores, which empower businesses to foresee potential payment delays at the account level. These scores adapt dynamically, ascending in correlation with timely customer payments and descending in cases of payment lags.

-

In the domain of collections management, effective segmentation of clientele into long-tail, high-value, or low-risk accounts is paramount. This segmentation facilitates the development of customized strategies for each category, optimizing resource allocation and enhancing the efficacy of the collection process. Armed with real-time performance data, accounts receivable managers are empowered to dynamically adjust strategies or ownership structures, ensuring adaptability and responsiveness in a fluid operational environment.

-

Full Data Transparency: Through advanced systems, collectors and AR managers attain complete visibility into payment delays, empowering them to identify contributing factors. This involves real-time monitoring of account statuses for open disputes or escalations, as well as tracking promise-to-pay (PTP) records.

-

The confluence of Augmented Reality (AR) systems with Customer Relationship Management (CRM) software delineates a transformative trajectory within organizational information management paradigms. This integration, epitomizing a strategic pivot towards centralized data repositories, facilitates the consolidation of disparate customer-centric datasets. By synergizing transaction histories, communication logs, and payment behaviors, businesses can harness comprehensive insights instrumental for agile decision-making. Moreover, this amalgamated reservoir serves as a catalyst for tailored sales and customer service strategies, particularly pertinent in scenarios necessitating nuanced interventions within the collections domain.

-

Enshrined within AR software, the collector’s dashboard symbolizes a transformative asset in refining collections management. It meticulously structures workloads, identifies accounts of heightened risk, and tracks customer correspondence with precision. Noteworthy features encompass automated reminders, adaptable communication frameworks, and comprehensive performance evaluations. Through amalgamating these features, collectors navigate their responsibilities adeptly, channeling efforts judiciously and fostering enhanced outcomes in reducing outstanding receivables.

Emerging Trends in Accounts Receivable Administration

The future trajectory of Augmented Reality (AR) presents an exciting revolution in receivable management for businesses, promising to elevate operational performance through enhanced efficiency, accuracy, and speed.

Next-Generation Tools: Harnessing Emerging Technologies for AR Management

-

AI/ML integration in AR management epitomizes a pivotal evolution reshaping contemporary operational landscapes. Through the utilization of sophisticated algorithms, these technologies adeptly decipher payment trends, forecast potential delays, and offer actionable insights to streamline payment operations. Their automation capabilities extend to routine tasks, such as reminders and payment reconciliations, enabling workforce redirection towards strategic endeavors. This transformative synergy between technology and operational processes heralds a new era of efficiency and agility within AR management frameworks.

-

Robotic Process Automation (RPA) represents a revolutionary mechanism capable of automating repetitive tasks, such as data entry, invoice generation, and the issuance of payment reminders. Through this implementation, the potential for human error is significantly reduced, thereby elevating the efficiency of the processes involved.

-

Through the strategic analysis of past data, predictive analytics empowers businesses to anticipate future customer payment patterns, facilitating proactive risk mitigation measures. This proactive stance enhances cash flow management efficiency and minimizes the occurrence of bad debts, thereby bolstering overall financial stability.

Understanding AI/ML’s Role in Augmented Reality Evolution

-

The fusion of AI and machine learning algorithms with credit risk analysis heralds a watershed moment in technological innovation. This convergence empowers financial institutions with unparalleled capabilities to dissect vast datasets and distill actionable insights in real-time. From parsing transaction histories to discerning market dynamics and social media signals, these advanced algorithms orchestrate a symphony of data-driven intelligence. This technological prowess not only augments the accuracy of credit risk assessments but also propels the industry towards a future where predictive analytics and autonomous decision-making reign supreme.

-

With the advent of AI-driven technologies, payment reminders are undergoing a paradigm shift as they embrace personalized communication strategies tailored to individual customer behaviors and preferences. This innovative approach not only fosters stronger customer relationships but also minimizes delinquency rates, optimizing overall payment outcomes.

-

Intellectual Evolution of Dispute Resolution: With the integration of artificial intelligence, we foresee a profound transformation in the resolution landscape. AI’s capacity to discern and classify disputes, drawing from past outcomes to propose optimal solutions, signifies a paradigmatic shift. Moreover, its ability to automate resolutions in straightforward cases heralds a departure from conventional methodologies, promising substantial efficiencies in time and resource utilization within the realm of dispute management.

-

Embracing machine learning algorithms for dynamic payment term customization heralds a new era in customer-centric marketing strategies. By tailoring payment terms to individual risk profiles and market dynamics, businesses can foster deeper customer engagement and loyalty. This innovative approach not only enhances customer satisfaction but also amplifies brand reputation and market positioning. Leveraging technology to offer flexible payment options demonstrates a commitment to meeting evolving consumer needs while maximizing revenue potential and market share.

Conclusion

-

Esteemed enterprises employ strategic methodologies and advanced technologies to effectively foresee and address payment delays. Through the strategic utilization of data analytics, artificial intelligence (AI), and machine learning, these organizations attain comprehensive insights into payment behaviors, facilitating precise forecasting and proactive measures.

-

The amalgamation of advanced communication tools and automated procedures serves to enhance the efficiency of AR management, facilitating prompt collections and reducing latency.

-

Enterprises bracing for prospective payment lags can bolster their cash reserves, cultivate enduring client partnerships, and circumvent potential financial obstacles. This forward-looking approach metamorphoses accounts receivable oversight from a mere reactive endeavor into an integral component of organizational strategy, fostering overarching stability and advancement.

-

This investment proposition emerges as a proactive measure to mitigate the multifaceted risks associated with payment delays, concurrently uncovering latent growth prospects. Through the strategic integration of technology and forward-looking planning in the realm of Accounts Receivable management, organizations can catalyze operational efficiencies, augment customer satisfaction metrics, and fortify their financial frameworks.

-

Invest in state-of-the-art predictive analytics solutions and comprehensive training modules tailored to mitigate payment delays effectively. Leverage cutting-edge technologies to empower your business with real-time insights and proactive intervention capabilities. By integrating advanced IT tools, you optimize operational efficiency, ensuring seamless cash flow management and positioning your enterprise for scalable success.