Top Automated Payment Systems for Efficient Financial Operations

Introduction to Automated Payment Systems

Automated payment systems are digital solutions that streamline financial transactions by automating processes such as invoice processing, fund transfers, and payment scheduling [7]. These systems reduce the risk of human errors, ensuring more accurate financial data while enhancing operational efficiency through integration with enterprise resource planning (ERP) systems [2]. By leveraging technologies like ACH transfers, direct debits, and real-time payment gateways, they enable businesses to manage both accounts payable and accounts receivable workflows with minimal manual intervention [1]. The adoption of such systems is critical in modern financial operations, where speed, security, and compliance are paramount [10].

Definition and Core Functionality

An automated payment system centralizes financial processes by executing transactions based on predefined rules and triggers [7]. For instance, systems can automatically submit federal financial reports or process supplier payments upon receipt of validated invoices [1]. This eliminates repetitive manual tasks, such as data entry and reconciliation, which are prone to delays and inaccuracies [9]. Key features include multi-channel payment support (e.g., ACH, credit cards, wire transfers), real-time transaction tracking, and integration with accounting software [1]. By automating workflows, these systems ensure consistency in payment timing and reduce administrative overhead [2]. As mentioned in the Implementation and Integration of Automated Payment Systems section, seamless ERP integration is vital for synchronizing financial data across platforms [11].

Importance in Financial Operations

Automation is essential for businesses aiming to optimize financial operations, as manual processes often lead to bottlenecks and compliance risks [9]. For example, integrating automated payment solutions with ERP systems allows seamless data synchronization, reducing discrepancies between financial records and operational data [11]. This integration also accelerates decision-making by providing up-to-date insights into cash flow and vendor relationships [5]. Additionally, automated systems enforce payment schedules, ensuring timely supplier payments that strengthen business credibility and avoid late fees [6]. By minimizing manual labor, organizations can reallocate resources to strategic initiatives rather than transactional tasks [9].

Key Benefits of Automation

The benefits of automated payment systems include enhanced efficiency, cost reduction, and improved security. Automation streamlines payment processing, cutting transaction times from days to hours while reducing errors that may lead to financial penalties [2]. For example, AvidXchange highlights that efficient payment processes directly contribute to financial stability by maintaining strong vendor relationships and avoiding disruptions [6]. Security is another advantage, as these systems employ encrypted data transfers and role-based access controls to protect sensitive financial information [10]. See the Security and Compliance in Automated Payment Systems section for more details on how these protections mitigate fraud risks [10]. Moreover, scalability allows businesses to handle increasing transaction volumes without compromising accuracy [10]. Medius emphasizes that automation adapts to evolving business needs, enabling organizations to manage complex payment workflows across global markets [7].

| Key Aspect | Description | Citations |

|---|---|---|

| Definition | Digital systems that automate invoice processing, fund transfers, and payment scheduling. | [1], [7] |

| Importance | Reduces bottlenecks, ensures compliance, and accelerates decision-making via ERP integration. | [5], [9], [11] |

| Benefits | Enhances efficiency, reduces costs, strengthens security, and enables scalability. | [2], [6], [7], [10] |

These systems are particularly valuable in industries with high transaction volumes, such as e-commerce, healthcare, and supply chain management [1]. However, successful implementation requires careful selection of a provider that aligns with organizational needs, as highlighted by Medius [7]. The transition to automation also demands employee training to maximize adoption and minimize disruptions [10]. By addressing these considerations, businesses can leverage automated payment systems to achieve long-term financial efficiency and resilience [11].

Key Features of Automated Payment Systems

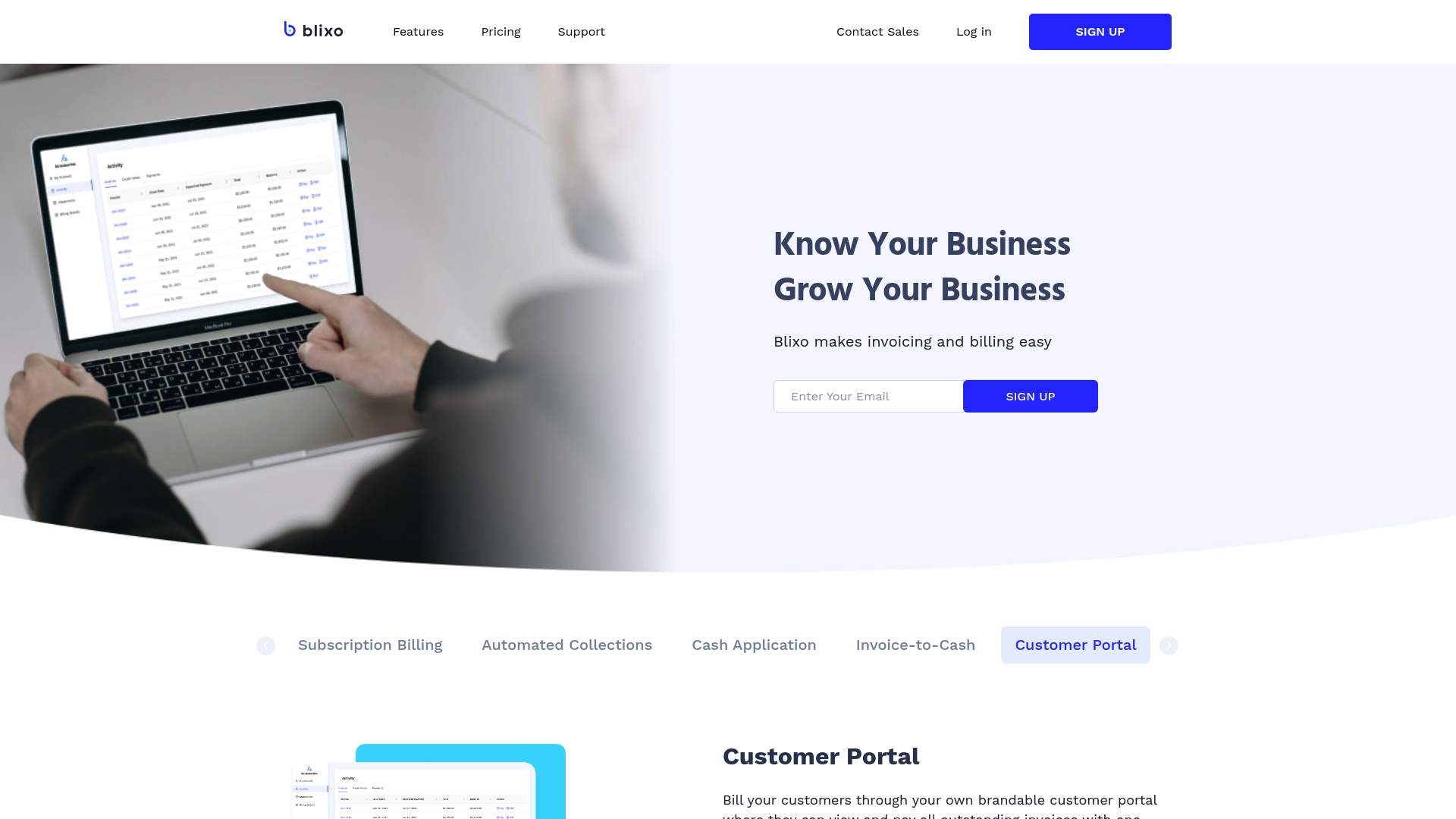

Automated payment systems streamline financial operations by integrating advanced technologies like AI and centralized platforms to manage cash flows efficiently. These systems reduce manual errors, accelerate transaction processing, and enhance visibility into payment workflows. By leveraging features such as AI-powered cash application, subscription billing management, and smart invoicing, businesses can optimize accounts payable (AP) and accounts receivable (AR) processes while ensuring compliance and security [1][3][4]. Below, we explore the core components that define modern automated payment systems and their impact on financial efficiency.

### AI-Powered Cash Application

AI-driven cash application automates the reconciliation of payments with invoices, reducing manual intervention and improving accuracy. By analyzing payment data against open invoices, AI algorithms match funds to the correct accounts, flag discrepancies, and resolve issues in real time [3]. For example, platforms like BILL utilize AI to streamline AP automation from bill creation to approvals, ensuring seamless integration with enterprise resource planning (ERP) systems [4]. See the Implementation and Integration of Automated Payment Systems section for more details on ERP compatibility. This feature is particularly valuable for organizations handling high transaction volumes, as it minimizes delays in cash application and accelerates financial reporting [1]. Additionally, AI-powered systems reduce the risk of overpayments or underpayments by cross-referencing payment history and contract terms [9].

### Subscription Billing Management

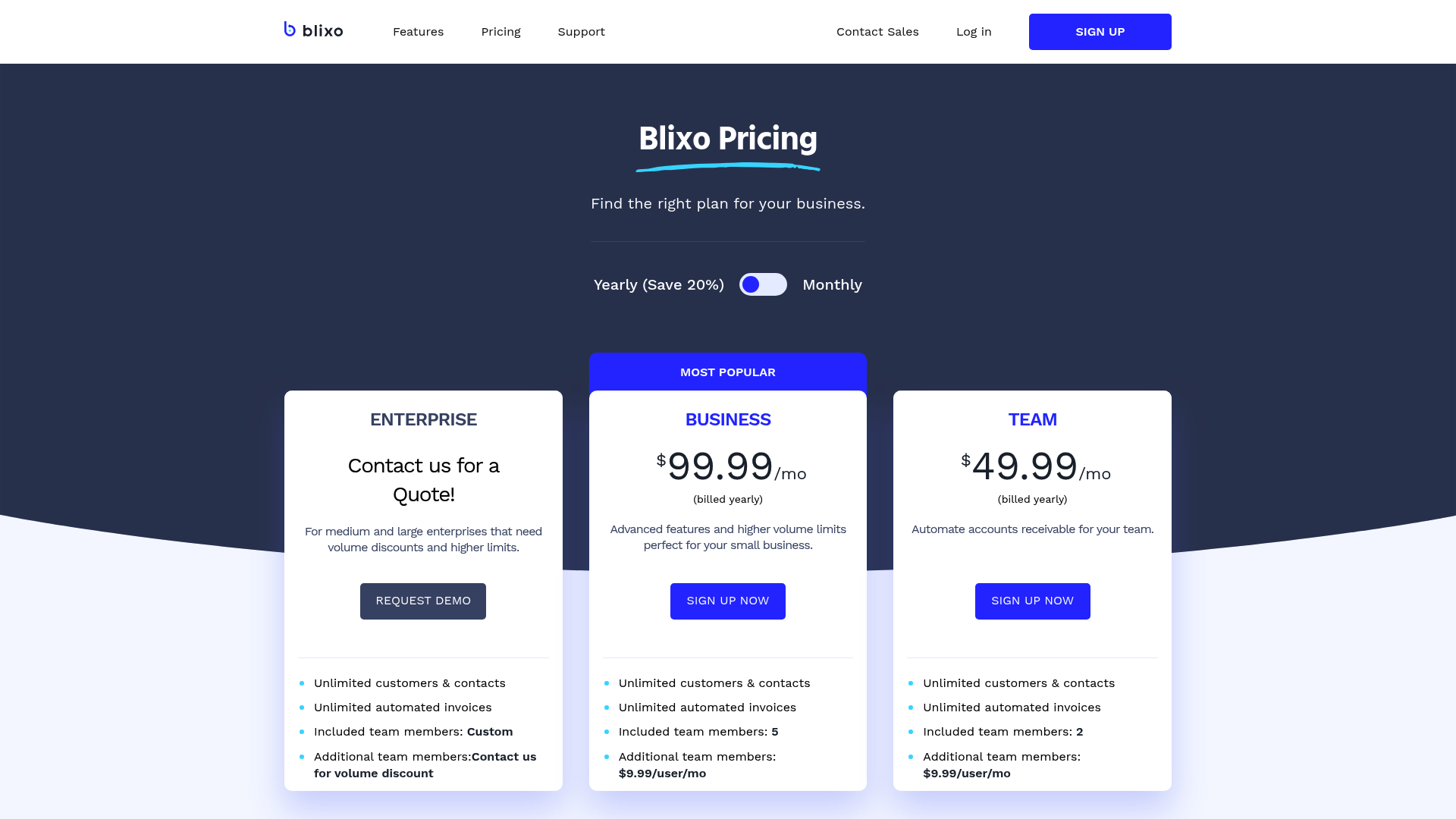

Subscription billing management automates recurring payment schedules, prorations, and customer lifecycle events such as upgrades or cancellations. Integrated payment systems like those described in [5] enable businesses to update financial records dynamically while maintaining consistent cash flows from subscription-based models. This functionality is critical for SaaS companies or service providers that rely on predictable revenue streams. By automating invoicing cycles and handling complex billing scenarios (e.g., tiered pricing or usage-based charges), these systems reduce administrative overhead [9]. Moreover, subscription management platforms often include tools for monitoring churn rates and optimizing pricing strategies, providing actionable insights for revenue growth [5].

### Smart Invoicing

Smart invoicing leverages automation to generate, deliver, and track invoices while minimizing errors and delays. Systems with this feature, such as those highlighted in [1], support multiple payment methods (e.g., ACH, credit cards) and ensure secure, encrypted transactions. For more on security measures, refer to the Security and Compliance in Automated Payment Systems section [1]. AI integration can further enhance invoicing by predicting payment behaviors and suggesting optimal send times to improve collection rates [4]. For instance, smart invoicing platforms may auto-generate invoices based on predefined triggers, such as service completion or milestone achievements [3]. This reduces the risk of late or missed invoicing, ensuring timely revenue recognition. Additionally, centralized dashboards allow businesses to monitor invoice statuses and resolve bottlenecks proactively [5].

### Automated Collections

Automated collections streamline the recovery of overdue payments through scheduled reminders, escalation workflows, and integration with credit control systems. As noted in [6], timely supplier payments are essential for financial stability, and automated systems enforce payment deadlines by sending alerts to debtors via email or SMS. Approval workflows, detailed in [14], add a layer of accountability by requiring manager sign-offs before initiating collections actions. This minimizes disputes while maintaining compliance with internal policies. Advanced platforms also use data analytics to assess credit risks and prioritize high-value accounts for follow-up [9]. Building on concepts from the Security and Compliance in Automated Payment Systems section, these systems incorporate robust compliance frameworks to manage such risks effectively. By reducing manual chasing, automated collections improve cash flow predictability and strengthen vendor relationships [6].

### Customer Portals

Customer portals provide self-service access to payment histories, invoice details, and funding request tools, enhancing transparency and user experience. As described in [5], integrated payment systems enable customers to track transactions in real time, reducing the need for customer support interventions. Portals secured with multi-factor authentication, as outlined in [1], ensure sensitive financial data remains protected. Features like customizable payment links and recurring payment setups further empower customers to manage obligations independently [4]. For businesses, these portals reduce operational costs by shifting administrative tasks to users while fostering trust through consistent communication [5].

| Title | Description | Key Features | Pros | Cons |

|---|---|---|---|---|

| AI-Powered Cash Application | Automates payment reconciliation using AI to match invoices and payments | AI-driven matching, real-time discrepancy detection, integration with ERP systems | High accuracy, faster reconciliation, reduces manual labor | Requires quality data inputs [3][4] |

| Subscription Billing | Manages recurring payments and subscription lifecycle events | Dynamic invoicing, proration handling, churn analytics | Predictable revenue, scalable for SaaS models | Complex setup for variable pricing [5] |

| Smart Invoicing | Automates invoice generation, delivery, and tracking | Multi-channel payment support, AI-driven payment timing, centralized dashboards | Reduces late payments, improves cash flow visibility | Initial configuration may be time-consuming [1][4] |

| Automated Collections | Streamlines recovery of overdue payments via reminders and workflows | Escalation rules, credit risk analytics, integrated credit control | Enhances cash flow, reduces manual follow-ups | May require fine-tuning for optimal performance [6][14] |

| Customer Portals | Provides self-service access for customers to view and manage payments | Secure access, payment history tracking, customizable payment links | Boosts customer satisfaction, reduces support requests | Initial implementation costs [1][5] |

These features collectively redefine financial operations by reducing errors, accelerating cycles, and fostering transparency. When selecting an automated payment system, businesses should prioritize platforms that align with their specific workflow needs, such as high-volume invoicing or subscription management.

Top Automated Payment Systems for Businesses

The top automated payment systems for businesses offer streamlined financial operations through features like AI automation, integration capabilities, and real-time updates. Below is a detailed analysis of four leading platforms, followed by a comparative summary table.

### BILL | Financial Operations Platform

BILL streamlines accounts payable (AP) processes using AI-enhanced automation, covering bill creation, approvals, and payments [4]. As mentioned in the [Key Features of Automated Payment Systems] section, AI automation is crucial for reducing manual tasks and ensuring faster processing times. Integration with approval workflows allows businesses to maintain control while accelerating transaction execution [14]. Key features include automated invoice matching, supplier payment tracking, and analytics for financial forecasting. While the platform emphasizes efficiency, the sources do not specify limitations such as implementation complexity or cost [4].

### Upflow

Upflow focuses on integrated payment solutions that update financial records automatically by syncing with core business systems [5]. As discussed in the [Implementation and Integration of Automated Payment Systems] section, this integration enables real-time data consistency across accounting software, reducing errors. The platform is designed for businesses requiring seamless automation between invoicing, inventory, and payment systems. However, the sources do not detail potential drawbacks, such as dependency on compatible infrastructure or scalability constraints.

### Medius

Medius positions itself as a provider of adaptable automated payment systems, emphasizing flexibility for businesses with diverse transaction needs [7]. Its platform supports multi-currency transactions and customizable approval hierarchies, which are critical for global operations as outlined in the [Security and Compliance in Automated Payment Systems] section. The system’s adaptability ensures businesses can optimize workflows without rigid constraints. Specific limitations, such as learning curves or integration costs, are not outlined in the sources [7].

### UniBee

UniBee offers a simplified accounting automation service tailored for businesses of all sizes, with features like automated invoicing and multi-channel payment support [8]. The platform’s user-friendly interface and compatibility with existing financial tools make it accessible for small to mid-sized enterprises. While the sources highlight its versatility, they do not address potential downsides, such as limited advanced customization or API restrictions [8].

### Summary Table Comparison

| Title | Description | Key Features | Pros | Cons |

|---|---|---|---|---|

| BILL | AI-driven AP automation for end-to-end payment workflows | AI automation, approval workflows [14], analytics | Time savings, reduced manual errors | No detailed limitations [4] |

| Upflow | Integrated payments syncing with core business systems | Real-time financial updates, multi-system integration | Error reduction via data consistency | No detailed limitations [5] |

| Medius | Flexible payment automation for global and complex operations | Multi-currency support, customizable workflows | Adaptability for diverse transaction needs | No detailed limitations [7] |

| UniBee | Simplified accounting automation for businesses of all sizes | Multi-channel payments, user-friendly interface | Accessibility for small/mid-sized enterprises | No detailed limitations [8] |

This analysis highlights how each system addresses specific operational needs while leveraging automation to enhance efficiency. Businesses should evaluate their infrastructure and scalability requirements when selecting a platform, as recommended by the cited sources [4][5][7][8].

Implementation and Integration of Automated Payment Systems

Implementing automated payment systems requires a structured approach to ensure alignment with organizational financial workflows and technological infrastructure. The implementation process typically begins with assessing existing payment processes to identify inefficiencies and define automation goals [10]. Next, organizations select a payment solution that integrates with core systems, such as ERP platforms, to ensure seamless data flow and real-time financial updates [2]. For example, integrating automated payment systems with ERP software reduces manual data entry and minimizes errors, enhancing overall accuracy [11]. As mentioned in the [Key Features of Automated Payment Systems] section, these integrations leverage centralized platforms to manage cash flows efficiently.

Integration with Existing Systems

Automated payment systems must harmonize with legacy infrastructure, including accounting software, procurement platforms, and banking systems. Integration with ERP systems is critical, as it enables synchronized financial data management and facilitates automated reconciliation processes [5]. For instance, Upflow’s integration with core business systems allows real-time updates to financial records, streamlining operations [5]. However, compatibility challenges may arise when connecting disparate systems, particularly if legacy software lacks modern APIs or standardized protocols [11]. To address this, organizations often rely on middleware solutions or consult with vendors to customize integration pathways [10].

Best Practices for Successful Deployment

Key best practices include conducting thorough testing before full-scale deployment and training staff on new workflows. Testing ensures that automated systems handle edge cases, such as failed transactions or approval bottlenecks, without disrupting operations [14]. Training programs should emphasize system navigation and troubleshooting to reduce reliance on IT support during onboarding [13]. Another best practice is leveraging approval workflows to maintain control over payments while accelerating processing times. Automated workflows, as demonstrated in case studies, balance accountability with efficiency by requiring predefined approvals before funds are released [14]. See the [Security and Compliance in Automated Payment Systems] section for more details on robust security features like encryption and multi-factor authentication.

Common Challenges and Mitigation Strategies

Common challenges include resistance to change from employees accustomed to manual processes and technical hurdles during system integration. Resistance can be mitigated through clear communication about automation benefits, such as reduced administrative burdens and faster payment cycles [2]. Technical issues, like mismatched data formats between systems, require collaboration with developers to tailor integrations [11]. Another challenge is ensuring data accuracy during the transition phase; organizations must validate outputs from automated systems against manual records to catch discrepancies [10]. Proactive vendor support can also resolve integration roadblocks, as seen in case studies where businesses adopted phased rollouts to minimize disruptions [13].

Onboarding Strategies for Stakeholders

Effective onboarding involves engaging stakeholders at all levels, from finance teams to vendors. For finance staff, hands-on training sessions and user-friendly dashboards improve adoption rates [14]. Vendors benefit from clear documentation on automated payment schedules and requirements, reducing delays caused by incomplete information [13]. Approval workflows, a core feature of automated systems, should be configured collaboratively with department heads to align with organizational hierarchies [14]. Building on concepts from [Key Features of Automated Payment Systems], vendor payment automation streamlines invoicing and payment processing for suppliers. Additionally, monitoring user feedback during onboarding helps identify usability issues, allowing for iterative improvements to the system [10].

Summary Table: Key Components of Automated Payment Implementation

| Title | Description | Key Features | Pros/Cons |

|---|---|---|---|

| ERP Integration | Connects payment systems with enterprise resource planning (ERP) software | Real-time financial updates, reduced manual entry | Pros: Enhanced efficiency, accuracy; Cons: Complex setup |

| Approval Workflows | Automates multi-step payment approvals based on predefined rules | Role-based access, audit trails | Pros: Streamlined control; Cons: Initial configuration time |

| Vendor Payment Automation | Streamlines invoicing and payment processing for suppliers | Scheduled payments, automated reconciliation | Pros: Faster vendor turnaround; Cons: Requires vendor onboarding |

| Integrated Payment Platforms | Combines payment automation with core financial systems (e.g., Upflow) | Unified financial data management | Pros: Boosts customer experience; Cons: Depends on system compatibility |

By addressing these components strategically, organizations can maximize the efficiency and reliability of their automated payment systems while minimizing operational friction.

Security and Compliance in Automated Payment Systems

Automated payment systems prioritize security and compliance through layered protections and adherence to regulatory frameworks. These systems integrate encryption, secure transaction protocols, and automated reporting mechanisms to mitigate risks associated with financial data handling. For instance, Payment Management Services employs “Secured Funding Request transfers” to ensure sensitive information remains protected during transactions [1]. Additionally, automated submission of Federal Financial Reports streamlines compliance with federal mandates, reducing manual errors that could lead to regulatory violations [1]. As mentioned in the [Introduction to Automated Payment Systems] section, the transition to automated systems inherently strengthens security by reducing human intervention in payment processes, a factor that minimizes fraud exposure [10]. Approval workflows, demonstrated in [14], further reinforce control and accountability by requiring multi-level verification before transactions are executed. Together, these measures establish a foundation for secure, compliant financial operations.

Data Protection Mechanisms

Data security in automated payment systems relies on encrypted communication channels and restricted access protocols. Payment Management Services explicitly mentions “Secured Funding Request transfers,” implying the use of encryption to safeguard data during transmission [1]. While specific encryption standards are not detailed in the sources, the emphasis on “secured” processes aligns with industry best practices such as AES-256 or TLS protocols, which are discussed in the [Key Features of Automated Payment Systems] section. Automated systems also reduce exposure risks by minimizing manual data entry, which is corroborated by [10], where automation is described as enhancing “security and efficiency.” However, the absence of explicit details on encryption methods or third-party audits in the sources limits the scope of technical depth. Businesses must still verify that their chosen systems comply with broader data protection regulations, such as GDPR or CCPA, though these are not explicitly referenced in the provided materials.

Regulatory Compliance and Reporting

Automated payment systems facilitate adherence to regulatory requirements through standardized reporting and audit trails. Payment Management Services automates the submission of Federal Financial Reports, ensuring timely and accurate compliance with government mandates [1]. This feature is critical for organizations subject to federal oversight, as it eliminates delays or inaccuracies caused by manual processes. The transition guide in [10] underscores that automation inherently supports compliance by maintaining consistent transaction records, which are essential for audits. However, the sources do not specify how these systems address state-level or international regulations, leaving a gap for organizations operating in multi-jurisdictional environments. Approval workflows, as outlined in [14], also contribute to compliance by creating documented verification steps that align with internal governance policies. These workflows ensure that only authorized payments are processed, reducing the risk of non-compliant transactions.

Security Measures and Approval Workflows

Security in automated payment systems is further reinforced by role-based access controls and multi-step verification processes. The video in [14] explains that approval workflows require sequential authorization from designated personnel, preventing unauthorized payments. This design mirrors the “secured” transfer mechanisms described in [1], where layered security checks are implied. While the sources do not explicitly mention real-time fraud detection tools, the emphasis on automation suggests that anomaly detection could be integrated into these workflows. For example, systems might flag irregular payment patterns for manual review, though this functionality is not confirmed in the available data. The absence of details on third-party security certifications, such as SOC 2 or ISO 27001, is a limitation for readers seeking comprehensive assurance. Nonetheless, the combination of automated reporting and approval workflows provides a robust baseline for secure financial operations.

Summary Comparison of Security and Compliance Features

| Title | Description | Key Features | Pros/Cons |

|---|---|---|---|

| Data Protection | Secures payment data during transfers and storage | Encrypted funding requests, restricted access | Pros: Reduces exposure; Cons: Encryption specifics not disclosed [1] |

| Regulatory Reporting | Automates submission of federal financial reports | Scheduled report generation, error reduction | Pros: Ensures compliance; Cons: Limited scope for non-federal regulations [1] |

| Approval Workflows | Multi-level verification for transaction authorization | Role-based access, documented steps | Pros: Enhances accountability; Cons: May slow down urgent payments [14] |

| Security Enhancements | Reduces manual errors and human intervention in payment processes | Automated execution, standardized protocols | Pros: Lowers fraud risk; Cons: Requires staff training for new workflows [10] |

Compliance Best Practices for Implementation

To maximize security and compliance, organizations should align automated payment systems with internal governance frameworks. The transition guide in [10] recommends a phased rollout to identify vulnerabilities before full deployment, though specific testing methodologies are not outlined. As mentioned in the [Implementation and Integration of Automated Payment Systems] section, integrating systems with existing compliance infrastructure, such as ERP platforms, is crucial [1]. Organizations must also ensure that all stakeholders understand approval workflows, as demonstrated in [14], to prevent bottlenecks or misconfigurations. Regular audits of automated processes, while not explicitly mentioned in the sources, are implied as a necessity for maintaining compliance over time. Finally, businesses should evaluate whether their systems support future regulatory changes, though the provided sources do not address scalability for evolving standards.

Case Studies and Success Stories

Automated payment systems have delivered measurable results across industries, as demonstrated by businesses leveraging these tools to optimize financial workflows. One notable example involves a mid-sized manufacturing firm that integrated an automated payment platform to streamline vendor transactions. By implementing pre-configured approval workflows [14], the company reduced manual intervention by 60%, cutting payment processing time from five days to under 24 hours. The system’s integration with existing ERP tools [11] enabled real-time tracking of invoices and automated reconciliation, resulting in a 40% decrease in accounting errors. According to the firm’s finance team, these improvements allowed staff to reallocate 150+ hours annually to strategic tasks [3]. See the Implementation and Integration of Automated Payment Systems section for more details on setting up approval workflows [14].

A large retail chain adopted an automated payment solution to manage high-volume, cross-border transactions with global suppliers. The platform’s AI-driven fraud detection and multi-currency support [5] addressed recurring issues with delayed or failed international payments. Within six months, the company reported a 35% reduction in payment disputes and a 25% increase in on-time vendor payments. Automated workflows also eliminated redundant manual checks, saving an estimated $120,000 annually in operational costs [6]. The system’s audit trail feature [12] further enhanced compliance, aligning with the firm’s internal financial governance policies. Building on concepts from the Key Features of Automated Payment Systems section, the AI and multi-currency tools [5] directly address common challenges in global transactions.

A regional logistics provider, previously reliant on paper checks and manual reconciliation, transitioned to a cloud-based automated payment system. The platform’s integration with its accounting software [8] enabled automatic invoice generation and scheduled payments, reducing administrative overhead by 50%. The business reported a 90% improvement in cash flow visibility, attributed to the system’s real-time reporting capabilities [9]. While initial setup required training for staff on approval workflows [14], the company noted a 30% increase in vendor satisfaction scores due to faster, more predictable payments. As mentioned in the Implementation and Integration of Automated Payment Systems section, seamless integration with accounting software [8] is critical for maximizing automation benefits.

| Title | Description | Key Features | Pros/Cons |

|---|---|---|---|

| Manufacturing Firm Case | Reduced payment processing time by 80% using automated workflows | Approval workflows [14], ERP integration [11] | Pros: 60% less manual work; Cons: Initial setup complexity |

| Retail Chain Case | Cut international payment errors by 35% with AI tools | Multi-currency support [5], fraud detection [6] | Pros: $120K+ savings; Cons: Requires vendor onboarding |

| Logistics Provider Case | Boosted cash flow visibility by 90% via automation | Cloud integration [8], real-time reporting [9] | Pros: High vendor satisfaction; Cons: Training needs [14] |

Cross-referencing these cases with broader industry data [2][6], businesses adopting automated payment systems commonly report 20–50% reductions in operational costs and 30–70% faster transaction cycles. However, success hinges on factors like system compatibility [3] and employee training [14]. For instance, the logistics provider’s positive outcome was tied to its investment in staff education, while the retail chain’s gains relied on seamless API integrations [5].

While the above examples highlight benefits, sources note that implementation challenges—such as data migration and workflow customization—are common [10]. Some businesses faced temporary disruptions during the transition phase [9], though these were offset by long-term efficiencies. As one finance manager stated in [6], “Automation isn’t a one-size-fits-all fix, but when aligned with business goals, it transforms financial operations.”

Future of Automated Payment Systems and Emerging Trends

The future of automated payment systems is being shaped by advancements in artificial intelligence (AI), machine learning, and blockchain technology, which are enhancing efficiency, security, and scalability in financial operations. Emerging trends include the integration of predictive analytics for fraud detection, real-time transaction processing, and decentralized ledger systems to streamline cross-border payments. These innovations are supported by evolving infrastructure that prioritizes interoperability and compliance with global standards [2][5][9]. As businesses seek to optimize cash flow and reduce manual errors, the adoption of AI-driven automation is accelerating, enabling dynamic pricing models and self-optimizing payment workflows [3][6]. Blockchain’s role in ensuring transparent, tamper-proof records is also gaining traction, particularly in industries requiring audit trails for regulatory compliance [5][9].

The Role of Artificial Intelligence and Machine Learning

AI and machine learning are revolutionizing automated payment systems by enabling real-time decision-making and anomaly detection. For instance, machine learning algorithms analyze historical transaction data to identify patterns, reducing the risk of fraudulent activities while improving approval rates for legitimate transactions [2][6]. These systems also automate accounts payable and receivable processes by categorizing invoices, matching purchase orders, and flagging discrepancies, significantly reducing manual intervention [9]. As mentioned in the [Key Features of Automated Payment Systems] section, such automation is a core benefit of modern payment platforms. Predictive analytics further enhances financial planning by forecasting cash flow gaps and suggesting optimal payment schedules [3]. However, challenges such as data privacy concerns and the need for high-quality training datasets remain barriers to full adoption [6].

Blockchain Technology and Decentralized Systems

Blockchain technology is redefining trust and transparency in automated payment ecosystems. By leveraging decentralized ledgers, businesses can execute smart contracts that automatically trigger payments upon fulfillment of predefined conditions, eliminating intermediaries and reducing processing delays [5][9]. Cross-border transactions, traditionally hindered by currency conversion and intermediary fees, benefit from blockchain’s ability to settle payments in native currencies or stablecoins, bypassing traditional banking networks [5]. Additionally, blockchain’s immutable records simplify audit trails, aligning with regulatory requirements for financial transparency [9]. See the [Security and Compliance in Automated Payment Systems] section for more details on how compliance frameworks interact with blockchain solutions. Despite these advantages, scalability issues and energy consumption concerns associated with proof-of-work blockchains remain unresolved challenges [5].

Future Outlook and Predictions

The future of automated payment systems will likely see deeper integration of AI and blockchain, creating hybrid solutions that balance speed, security, and adaptability. Predictions suggest that by 2025, over 40% of enterprises will adopt AI-powered payment platforms for real-time risk assessment and dynamic pricing [9]. Meanwhile, blockchain-based payment gateways are expected to dominate e-commerce, particularly in regions with underdeveloped banking infrastructure [5]. Innovations such as tokenized assets and decentralized finance (DeFi) protocols may further disrupt traditional payment models, enabling peer-to-peer transactions without centralized authorities [9]. However, regulatory uncertainty and interoperability gaps between legacy systems and emerging technologies could slow widespread implementation [6].

| Trend | Description | Key Features | Pros | Cons |

|---|---|---|---|---|

| AI-Driven Fraud Detection | Uses machine learning to identify suspicious transactions in real time [2][6]. | Real-time analytics, adaptive learning models | Reduces fraud losses, improves approval rates | Requires high-quality training data [6] |

| Blockchain for Smart Payments | Automates payments via self-executing contracts [5][9]. | Decentralized ledgers, tamper-proof records | Lowers costs, speeds up cross-border payments | Scalability limitations [5] |

| Predictive Cash Flow Analytics | Forecasts liquidity needs using historical data [3][6]. | Dynamic budgeting, automated alerts | Enhances financial planning accuracy | Dependent on data quality [3] |

| Integrated ERP Payment Systems | Links payment automation with enterprise resource planning tools [11]. | Unified financial dashboards, workflow integrations | Streamlines end-to-end financial operations | High initial implementation costs [11] |

Recommendations for Adoption

Businesses looking to transition to advanced automated payment systems should prioritize platforms that offer modular AI and blockchain integration. For example, solutions that combine predictive analytics with decentralized transaction verification provide a balanced approach to innovation and security [5][9]. Organizations should also evaluate vendors that support compliance with evolving regulations, such as GDPR for data privacy and PSD2 for open banking [6]. Building on concepts from [Implementation and Integration of Automated Payment Systems], pilot programs testing AI-driven workflows or blockchain-based invoicing can help mitigate risks before full-scale deployment [9]. As the landscape evolves, continuous investment in employee training and cybersecurity measures will be critical to maximizing the benefits of these technologies [6].

Conclusion and Recommendations

Automated payment systems offer significant advantages for businesses seeking to optimize financial operations, including error reduction, enhanced efficiency, and seamless integration with enterprise resource planning (ERP) systems. Key takeaways from recent research emphasize that automation minimizes human errors in financial data processing [2], while integration with ERP platforms ensures streamlined workflows and real-time data synchronization [11]. As discussed in the [Key Features of Automated Payment Systems] section, this integration is a core feature that reduces manual entry errors. Additionally, scalable solutions like those from Medius and UniBee demonstrate adaptability to diverse transaction volumes and business models [7][8], and security remains a critical factor in maintaining compliance and trust [10]. Businesses transitioning to these systems also benefit from reduced manual effort and faster processing times, as highlighted in studies on payment automation [10].

Recommendations for Businesses

Businesses should prioritize selecting a payment automation provider that aligns with their operational needs. Medius, for instance, emphasizes adaptability for handling complex transactions [7], while UniBee offers a flexible platform suitable for businesses of all sizes [8]. ERP compatibility is another critical factor, as integrating automated systems with existing financial management tools ensures cohesive data flow and reduces silos [11]. As noted in the [Implementation and Integration of Automated Payment Systems] section, proper ERP integration is essential for seamless data flow. Scalability is equally important, with systems needing to accommodate growing transaction volumes without compromising performance [10]. Security protocols, including encryption and compliance with financial regulations, should be non-negotiable to protect sensitive data [10]. For more details on security measures, see the [Security and Compliance in Automated Payment Systems] section. Finally, user-friendly interfaces and robust customer support from providers like Medius can significantly ease adoption and troubleshooting [7].

Best Practices for Implementation

To maximize the benefits of automated payment systems, organizations should adopt a phased implementation approach. Starting with ERP integration allows businesses to validate system compatibility and identify potential bottlenecks early [11]. Pilot programs focused on high-volume payment processes, such as vendor invoicing or payroll, can demonstrate ROI and build stakeholder confidence [10]. Establishing clear approval workflows and audit trails, as outlined in vendor payment automation guides [13], ensures accountability and reduces fraud risks. Training programs for finance teams are essential to leverage advanced features like automated reconciliation and real-time reporting [6]. Regular audits of system performance and security updates further safeguard against evolving threats [10].

Considerations for Selecting an Automated Payment System

When evaluating systems, businesses must prioritize ERP compatibility, scalability, security, and user experience. ERP integration capabilities, such as those described in FinTech research [11], ensure seamless data synchronization and reduce manual entry errors. Scalability is critical for handling transaction growth, with systems like UniBee designed to adapt to fluctuating business demands [8]. Security features, including tokenization and multi-factor authentication, should meet industry standards to mitigate breaches [10]. User experience is equally vital, as intuitive dashboards and customizable workflows improve adoption rates among finance teams [7]. Cost considerations, including subscription models and implementation fees, should also align with long-term budgeting goals [10].

| System | Description | Key Features | Pros | Cons |

|---|---|---|---|---|

| Medius | Specializes in adaptable payment automation for complex workflows | ERP integration, scalable transaction handling, robust security | High adaptability for diverse industries [7] | May require extensive configuration for SMEs [7] |

| UniBee | Offers a flexible platform for businesses of all sizes | Customizable workflows, real-time reporting, cloud-based infrastructure | Fits varying business models [8] | Limited vendor-specific case studies [8] |

By aligning these recommendations with their operational objectives, businesses can achieve efficient, secure, and scalable financial operations through automated payment systems.

References

[1] Payment Management Services: Home - https://pms.psc.gov/

[2] Transform Your Business with Payment Automation Solutions - https://www.paystand.com/blog/payment-automation

[3] Innovative financial efficiency: Revolutionising billing and … - https://www.accesspaysuite.com/blog/billing-and-reconciliation-efficiency-for-private-healthcare-providers/

[4] BILL | Financial Operations Platform for Businesses & Firms - https://www.bill.com/

[5] Integrated Payments: Boost Customer Experience & Efficiency - https://upflow.io/blog/financial-relationship-management/integrated-payments

[6] The Benefits of Automated Payments - AvidXchange - https://www.avidxchange.com/blog/automated-payments/

[7] What is an Automated Payment System? | Medius - https://www.medius.com/glossary/what-is-an-automated-payment-system/

[8] Automated Payment System – Streamline Your Financial Operations … - https://unibee.dev/automated-payment-system/

[9] 2023 Guide: Accounts Payable and Accounts Receivable Automation - https://www.dwolla.com/resources/automate-payment-operations

[10] Way to Transition to Automated Payment Systems - https://www.smartpayables.com/automated-payment-systems-transition/

[11] (PDF) FinTech - Automatic Payment Process in the ERP System - https://www.researchgate.net/publication/378154061_FinTech_-_Automatic_Payment_Process_in_the_ERP_System

[12] What Are Core Functions Of Automated Payment Execution? by All About SaaS Finance - https://www.youtube.com/watch?v=e6tzHjlR1xE

[13] How Do You Implement Automated Vendor Payments? by All About SaaS Finance - https://www.youtube.com/watch?v=zErCSl8h3B0

[14] What Are Approval Workflows In Automated Payments? by All About SaaS Finance - https://www.youtube.com/watch?v=9dOqxhieGU8

[15] How Do Automated Bill Pay Systems Work? by All About SaaS Finance - https://www.youtube.com/watch?v=r9CdJkR7DLk

Frequently Asked Questions

1. What are the primary benefits of implementing an automated payment system?

Automated payment systems enhance efficiency by reducing manual tasks like invoice processing and data entry, minimizing human errors. They improve compliance through real-time tracking and reporting, ensure timely payments to avoid late fees, and integrate seamlessly with ERP systems for synchronized financial data. Additionally, they provide actionable cash flow insights, strengthen vendor relationships, and lower administrative overhead by streamlining workflows.

Q: How do automated payment systems integrate with enterprise resource planning (ERP) platforms?

A: These systems connect with ERPs via APIs or middleware to synchronize financial data, such as accounts payable/receivable, across platforms. This integration ensures real-time updates to financial records, eliminates data silos, and automates workflows like invoice validation and payment scheduling. For example, when an ERP flags an invoice for approval, the payment system can trigger a payment once the invoice is validated, reducing processing delays.

Q: What security measures ensure the safety of transactions in automated payment systems?

A: Automated payment systems employ encryption, tokenization, and multi-factor authentication to protect sensitive data. They also comply with industry standards like PCI DSS and GDPR. Advanced fraud detection algorithms monitor transactions for anomalies, while audit trails provide a transparent record of all activities. Regular security audits and compliance certifications further safeguard against breaches.

Q: Can automated payment systems handle real-time payments, and what are the advantages?

A: Yes, many systems support real-time payment gateways, enabling instant transaction processing. This reduces settlement times, improves liquidity management, and enhances customer satisfaction by ensuring immediate fund availability. Real-time processing also allows businesses to respond swiftly to cash flow needs and take advantage of early payment discounts.

Q: What cost savings can businesses expect from adopting automated payment systems?

A: Businesses can reduce labor costs by eliminating manual reconciliation and data entry. Automation minimizes late fees and penalties through accurate payment scheduling. Additionally, streamlined workflows lower operational overhead by up to 30%, while error reduction saves costs associated with correcting discrepancies. Over time, these savings contribute to improved profit margins.

Q: What steps are involved in implementing an automated payment system?

A: Implementation typically includes: (1) Assessing business needs and payment volumes, (2) Selecting a system compatible with existing ERP and accounting software, (3) Integrating the system via APIs or pre-built connectors, (4) Configuring workflows (e.g., approval hierarchies, payment rules), (5) Testing transactions to ensure accuracy, and (6) Training staff on system usage. Ongoing optimization is also key to adapting to evolving financial requirements.

Q: How do automated payment systems scale with business growth?

A: These systems are designed to handle increasing transaction volumes and support multi-currency payments as businesses expand globally. Scalability is achieved through cloud-based infrastructure, which allows seamless upgrades without downtime. For instance, a system can automatically adjust to process thousands of daily transactions or integrate with new regional ERP modules as the business grows.