Streamline Business Operations with Automated Payments

Related Video

Watch: Business Payment Best Practices: Simplifying and Automating Accounts Payables and Receivables by Enkel Backoffice Solutions

Streamlining Business Operations with Automated Payments

Automated payments leverage technology to streamline financial transactions, reducing reliance on manual processes like paper checks or legacy systems [1]. By integrating automated solutions, businesses can execute payments—whether for subscriptions, vendor invoices, or employee benefits—without time-consuming human intervention [2]. This system relies on software to handle tasks such as invoice processing, procurement, and reconciliation, ensuring accuracy and speed [3]. For companies managing recurring payments or accounts receivable, automation eliminates errors caused by manual data entry and accelerates cash flow cycles [6]. Key platforms like Dwolla and Stripe offer tools that digitize ACH transfers and payment workflows, enabling businesses to scale operations efficiently [1].

Key Benefits for Business Operations

Automated payments deliver measurable efficiency gains across financial operations. By digitizing payment processes, businesses reduce processing times by over 50%, as seen in case studies from Bottomline’s Paymode network [9]. This efficiency extends to accounts payable (AP) and accounts receivable (AR) management, where platforms like BILL automate invoice creation, payment scheduling, and reconciliation, minimizing delays [4]. For subscription-based models, automation ensures consistent billing cycles and reduces churn caused by failed payments. See the [Implementing Subscription Billing Management] section for more details on optimizing recurring payment workflows [6]. Additionally, businesses using tools like WEX can simplify complex workflows such as fuel card management or employee benefits distribution, which traditionally require manual oversight [5].

Financial controls also improve with automation. Payment automation software adds layers of security, reducing fraud risks through encrypted transactions and real-time monitoring [7]. For instance, Stripe’s automated systems flag suspicious activity while maintaining compliance with payment regulations [2]. These tools also provide visibility into cash flow, enabling businesses to forecast expenses and manage budgets dynamically [4]. By eliminating manual reconciliation, companies avoid discrepancies that arise from human error, ensuring financial reporting remains accurate [3].

Importance of Automation in Financial Operations

The shift to automated payments is critical for modernizing financial operations. Integrating these systems with ERP platforms, as outlined in fintech research, allows businesses to align payment processes with broader financial management goals. See the [Best Practices for Automating Financial Operations] section for guidance on selecting tools compatible with ERP systems [10]. This integration ensures that procurement, invoicing, and payroll workflows are synchronized, reducing operational friction [6]. For high-volume transactions, such as payroll or vendor payments, automation prevents bottlenecks by executing payments 24/7 without downtime [1].

Moreover, automation supports agility in dynamic markets. Platforms like SS&C Blue Prism enable businesses to adapt payment strategies quickly, whether scaling up during growth phases or adjusting to regulatory changes [3]. This flexibility is vital for companies handling international transactions, where automated systems can manage currency conversions and compliance requirements seamlessly [2]. By reducing the administrative burden on finance teams, automation allows employees to focus on strategic tasks like cost analysis or revenue forecasting [7].

Businesses adopting automated payments also gain a competitive edge through enhanced customer experiences. Subscription services benefit from uninterrupted billing, while vendors appreciate faster payment cycles [6]. For example, Plooto’s platform streamlines AP and AR processes, ensuring vendors receive payments on time and customers avoid service disruptions [11]. Such improvements strengthen business relationships and reinforce trust in financial operations [4].

Implementing Automated Payment Systems

To adopt automated payments, businesses must evaluate tools that align with their operational needs. Key considerations include compatibility with existing ERP systems. Building on concepts from the [Best Practices for Automating Financial Operations] section, prioritize integration with ERP platforms during implementation [10]. Support for recurring payments [6], and integration with financial controls [7]. Platforms like Bottomline and BILL offer modular solutions tailored to industries with complex payment workflows, such as construction or healthcare [4].

Implementation steps typically involve:

- Mapping Payment Workflows: Identify processes prone to delays, such as manual invoice approvals [6].

- Selecting a Platform: Choose a provider offering ACH, card, or cross-border payment capabilities [1].

- Integration Testing: Ensure the system synchronizes with accounting software and ERP tools. See the [Best Practices for Automating Financial Operations] section for more details on selecting tools with ERP compatibility [10].

- Training Teams: Equip finance staff with tools to monitor automated transactions and resolve exceptions [7].

By following these steps, businesses can transition from fragmented payment systems to cohesive, automated operations that reduce costs and enhance scalability [9]. The result is a financial infrastructure capable of supporting growth while maintaining compliance and security [2].

Understanding Automated Accounts Receivable Processes

Automated accounts receivable (AR) processes transform how businesses manage invoicing, collections, and payment reconciliation. By leveraging technology, organizations reduce manual workflows, minimize errors, and accelerate cash flow. Key components include smart invoicing, automated collections, AI-powered cash application, and intelligent matching engines. These systems integrate with financial platforms like BILL [4] and payment networks such as Bottomline’s Paymode [9], enabling seamless automation from invoice generation to payment settlement. Below, we break down each component and its role in streamlining AR operations.

### Smart Invoicing

Smart invoicing automates the creation, delivery, and tracking of invoices. Platforms like BILL [4] and Stripe [2] use software to generate accurate, timely invoices based on predefined rules, such as order fulfillment dates or contract terms. These systems eliminate manual data entry by pulling information from ERP systems [10], reducing errors and ensuring compliance with billing schedules. As mentioned in the [Best Practices for Automating Financial Operations] section, integrating with ERP systems is crucial for seamless automation. For example, automated solutions can send invoices via email or digital portals, with real-time status updates on payment receipt [6]. This transparency helps businesses monitor outstanding balances and forecast cash flow more effectively. By digitizing the invoicing process, companies cut processing time and avoid delays caused by paper-based workflows [3].

### Automated Collections

Automated collections streamline the follow-up process for overdue payments. Tools like SS&C Blue Prism’s payment automation [3] and Bottomline’s digitized payment systems [9] use pre-set rules to trigger reminders, escalation emails, and even late fees. These systems prioritize accounts based on payment history and risk scores, ensuring high-value or delinquent accounts receive immediate attention. For instance, automated platforms can send initial reminders 10 days post-due date, escalate to phone calls 15 days overdue, and flag accounts for manual review after 30 days [6]. This structured approach reduces the need for human intervention while improving collection rates. Additionally, integration with ERP systems [10] ensures that collections workflows align with broader financial operations.

### AI-Powered Cash Application

AI-powered cash application uses machine learning to match incoming payments with corresponding invoices. Traditional reconciliation requires manual verification, but systems like those described in Stripe’s payment automation guide [2] and Bottomline’s solutions [9] automate this process. AI algorithms analyze payment data, such as remittance details and bank transaction codes, to apply funds to the correct accounts. For example, if a customer sends a payment without specifying the invoice number, the AI cross-references payment amounts and dates to identify the correct match [8]. This reduces reconciliation time from hours to minutes, as noted in studies on payments lifecycle automation [8]. By minimizing human error, businesses avoid underpayments or overpayments and maintain accurate financial records.

### Intelligent Matching Engine for Payments

An intelligent matching engine enhances payment accuracy by validating transactions across multiple data sources. These engines, often embedded in platforms like BILL [4] and Paymode [9], compare payment details (e.g., amount, currency, payer information) against invoice records and contract terms. If discrepancies arise—such as a mismatch between the invoice total and the payment amount—the system flags the transaction for review [10]. Advanced engines also support multi-currency and cross-border payments by applying real-time exchange rates and compliance checks [2]. For instance, Bottomline’s systems report a 50% reduction in processing time by automating receipt and reconciliation [9]. This ensures that payments are applied correctly and that disputes are resolved faster.

### Integration and Scalability

The effectiveness of automated AR processes depends on integration with existing financial systems. ERP platforms, as highlighted in FinTech research [10] and discussed in the [Best Practices for Automating Financial Operations] section, serve as central hubs for connecting invoicing, collections, and payment reconciliation tools. APIs and middleware facilitate data exchange between AR automation software and accounting systems like QuickBooks or SAP [10]. Scalability is another advantage: as businesses grow, automated systems handle increased transaction volumes without proportionally increasing labor costs [6]. For example, SS&C Blue Prism’s automation solutions [3] scale dynamically, adjusting workflows to match seasonal demand or expansion into new markets. This adaptability ensures that AR processes remain efficient even during periods of rapid growth.

By adopting these technologies, businesses eliminate bottlenecks in their AR workflows while improving visibility into cash flow. The combination of smart invoicing, automated collections, AI-driven reconciliation, and intelligent payment matching creates a cohesive system that reduces manual effort and accelerates revenue realization. As demonstrated by case studies from Stripe [2], Bottomline [9], and others, organizations leveraging these tools achieve faster payment cycles and stronger financial performance.

Implementing Subscription Billing Management

Implementing subscription billing management requires automating recurring invoice generation, adhering to billing best practices, and streamlining dunning processes to minimize revenue loss. Automated systems reduce manual intervention by generating invoices on predefined schedules, such as monthly or annual cycles, and delivering them directly to customers via email or integrated platforms [2]. For example, Stripe’s payment automation tools allow businesses to configure billing cycles that align with customer agreements, ensuring consistency and reducing administrative overhead [2]. Recurring invoices must also include dynamic data, such as prorated charges for mid-cycle upgrades or downgrades, which automated systems handle by recalculating amounts based on subscription changes [7]. This eliminates errors associated with manual adjustments while maintaining compliance with financial reporting standards [10].

Subscription Billing Best Practices

To optimize subscription billing, businesses should prioritize transparency and flexibility. Clear communication of billing terms, including renewal dates and payment methods, reduces customer disputes and improves retention [2]. Automated platforms like Bottomline’s Payment Lifecycle Automation enable businesses to offer multiple payment options, such as ACH, credit cards, or digital wallets, ensuring customers can pay via their preferred method [7]. Integration with accounting systems is another critical best practice; ERP-compatible payment automation tools, such as those described in FinTech research, synchronize subscription data with financial records in real time, reducing reconciliation delays [10]. See the Understanding Automated Accounts Receivable Processes section for more details on ERP integration and payment reconciliation workflows. Additionally, businesses must implement fraud detection mechanisms, such as address verification and transaction monitoring, to prevent unauthorized charges while maintaining a seamless user experience [2].

Dunning and Chasing Processes

Automated dunning management is essential for recovering failed payments and maintaining cash flow. Stripe’s documentation highlights systematic approaches to dunning, including immediate retries with alternative payment methods and tiered notifications (e.g., email reminders, SMS alerts) for customers with failed transactions [2]. For instance, if a payment fails due to insufficient funds, the system can automatically pause the subscription and send a notification prompting the customer to update their payment details [7]. Businesses should also establish grace periods and late fee policies that align with industry standards, ensuring compliance while balancing customer retention [2]. Bottomline’s Business Payments Transformation framework emphasizes the use of analytics to identify patterns in failed payments, such as seasonal spending fluctuations, allowing proactive adjustments to billing strategies [7]. Building on concepts from Overcoming Challenges in Automated Payment Systems, these analytics help address integration complexities and improve system adaptability [5].

By combining recurring invoice automation, transparent billing practices, and data-driven dunning processes, businesses can reduce churn, improve operational efficiency, and ensure predictable revenue streams. Payment automation tools, as outlined in SS&C Blue Prism’s analysis, eliminate the need for manual reconciliation and error-prone workflows by centralizing subscription management within a unified platform [3]. As mentioned in the The Role of Customer Portal in Automated Payments section, empowering customers with self-service payment options further enhances transparency and reduces administrative burdens [4]. However, success depends on continuous monitoring and adaptation to customer feedback, ensuring that automated systems remain aligned with evolving business needs [2].

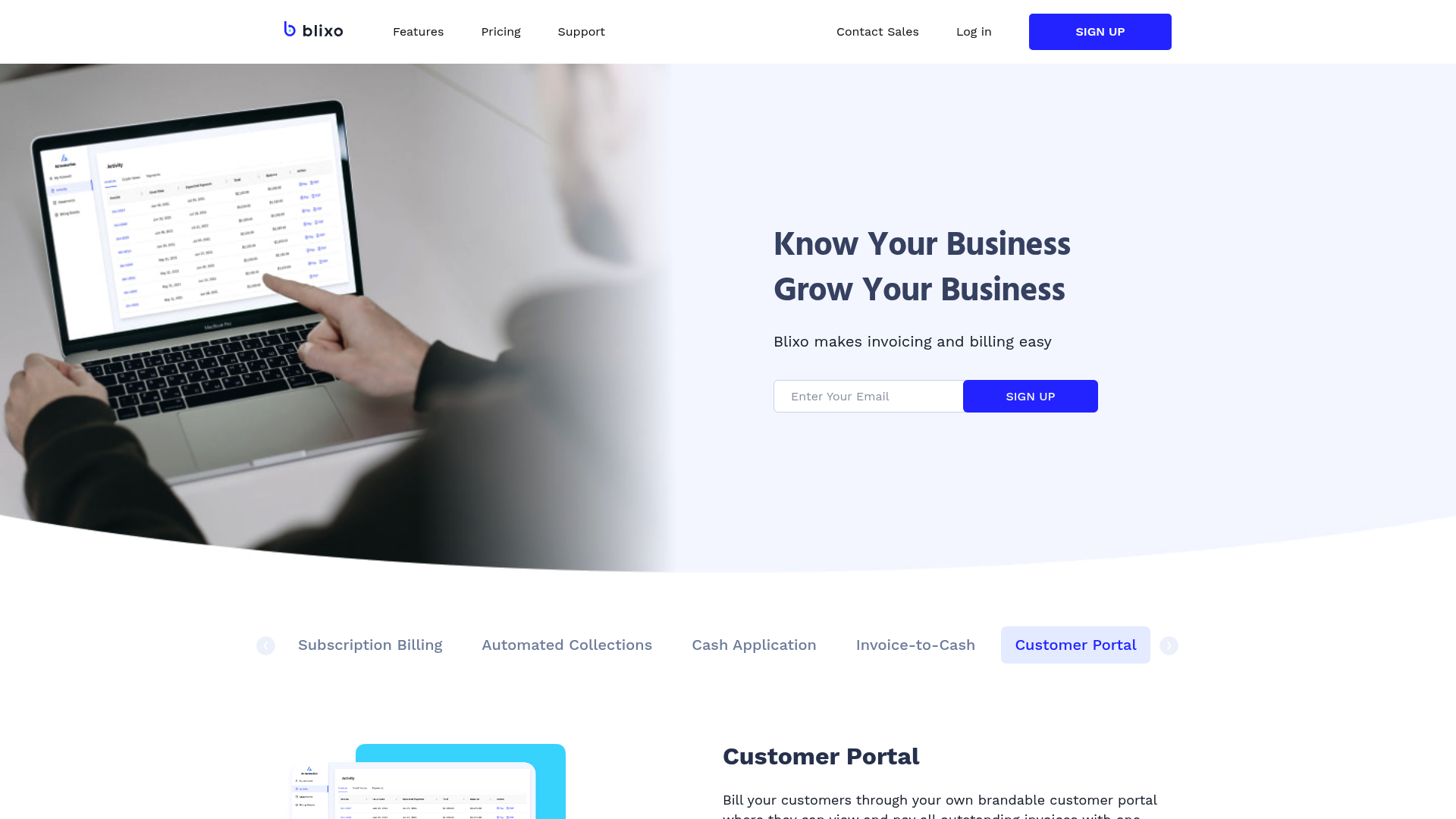

The Role of Customer Portal in Automated Payments

Customer portals play a critical role in automated payments by centralizing payment management, improving transparency, and empowering clients to interact with financial systems efficiently. These portals integrate with automated payment platforms to enable self-service payment initiation, real-time tracking of transactions, and access to financial data. By consolidating payment processes into a single interface, customer portals reduce manual intervention, minimize errors, and ensure compliance with payment schedules [2]. For example, Dwolla’s customer portal allows clients to monitor payment statuses and view transaction histories, streamlining reconciliation and audit processes [1]. This level of accessibility ensures businesses and clients can maintain financial oversight without relying on intermediaries. As mentioned in the [Streamlining Business Operations with Automated Payments] section, reducing manual processes is a key benefit of automation.

Customer Portal Features for Automated Payments

Customer portals offer a suite of features designed to support automated payment workflows. Key functionalities include self-service payment tools, customizable payment schedules, and integration with accounting systems. Stripe’s payment automation solutions, for instance, enable customers to set up recurring payments directly through the portal, aligning with predefined business rules and compliance frameworks [2]. This aligns with the automated workflows discussed in the [Implementing Subscription Billing Management] section. Similarly, platforms like BILL provide real-time access to invoices, payment history, and customizable reporting tools, allowing clients to manage cash flow proactively [4]. These features not only enhance payment accuracy but also reduce the administrative burden on finance teams. Additionally, portals often support multi-channel payment options, including ACH, credit cards, and digital wallets, ensuring flexibility for diverse customer preferences [1].

Financial Reports and Analytics

A core benefit of customer portals is their ability to deliver actionable financial insights through automated reporting. By aggregating transaction data, payment trends, and reconciliation records, portals generate real-time analytics that support informed decision-making. Bottomline’s Business Payments Transformation suite, for instance, offers dashboards that track payment performance metrics and highlight anomalies, such as delayed transactions or fraudulent activity [7]. These reports are often customizable, allowing businesses to filter data by timeframes, payment types, or client segments [4]. For clients, access to such analytics reduces dependency on finance teams for routine queries and fosters greater accountability. Furthermore, automated reporting minimizes the risk of human error in data compilation, ensuring accuracy in financial forecasting and audit trails [10].

Enhancing Customer Experience

Customer portals elevate the user experience by prioritizing transparency, speed, and control. Features like instant payment confirmations, proactive alerts for due dates, and 24/7 access to financial records reduce friction in client interactions. According to WEX, businesses that implement customer portals report higher satisfaction rates due to reduced payment processing delays and improved communication [5]. For example, portals can send automated notifications for successful or failed transactions, enabling clients to resolve issues immediately [1]. Additionally, self-service portals empower customers to update payment methods, dispute charges, or request refunds without involving support teams [6]. This autonomy not only accelerates resolution times but also aligns with modern expectations for digital-first financial interactions.

Integration and Scalability

Effective customer portals are built on scalable architectures that integrate seamlessly with existing payment infrastructures. Solutions like SS&C Blue Prism emphasize the importance of modular portal designs that adapt to evolving business needs, such as adding new payment gateways or expanding into international markets [3]. By leveraging APIs, portals can synchronize with ERP systems, CRM platforms, and automated billing tools, ensuring data consistency across ecosystems [10]. This interoperability is critical for businesses handling high-volume transactions, as it prevents bottlenecks and maintains service reliability. As highlighted in the [Best Practices for Automating Financial Operations] section, integration capabilities are a key consideration when selecting automation tools. Moreover, portals with role-based access controls ensure that sensitive financial data remains secure while providing tailored views for different user groups [4].

In summary, customer portals are indispensable for optimizing automated payment systems. Their features streamline payment execution, their analytics provide strategic value, and their user-centric design strengthens client relationships. By adopting a portal solution aligned with automated payment workflows, businesses can achieve operational efficiency while meeting the demands of a digitally driven financial landscape [1][2][7].

Overcoming Challenges in Automated Payments

Integration Challenges in Automated Payment Systems

Integrating automated payment systems often requires reconciling differences between legacy infrastructure and modern payment platforms. Businesses using outdated systems, such as paper checks or manual ACH processes, face hurdles when connecting to automated solutions like Dwolla’s Pay by Bank or ACH APIs [1]. For example, ERP systems may struggle with data synchronization when integrated with automatic payment tools, requiring careful configuration to align financial data across platforms [10]. To mitigate this, businesses should prioritize APIs that support modular integration, allowing incremental adoption without overhauling existing workflows, as discussed in the [Best Practices for Automating Financial Operations] section [8]. Additionally, financial operations platforms like Bottomline emphasize the need for middleware solutions to bridge gaps between disparate systems, ensuring seamless data flow between payment processors and accounting software [7].

Troubleshooting Common Automation Issues

Automated payment systems may encounter recurring issues such as failed transactions, delayed settlements, or data mismatches. ERP integrations, for instance, often face errors due to inconsistent data formats or incomplete mapping between payment platforms and internal financial systems [10]. To address these problems, businesses must implement robust error-handling protocols, including automated alerts and reconciliation tools. Bottomline’s Business Payments Transformation framework recommends leveraging payment lifecycle automation software to track and resolve issues in real time, reducing manual intervention [7]. Similarly, Dwolla highlights the importance of testing environments to simulate payment scenarios and identify bottlenecks before full-scale deployment [1]. For businesses using agentic automation, iterative testing with small transaction batches ensures compatibility and minimizes disruption [8].

Compliance and Security Concerns

Automated payments introduce compliance risks related to financial regulations, data privacy, and fraud prevention. ACH transactions, for instance, must adhere to NACHA guidelines to avoid penalties, while cross-border payments require compliance with anti-money laundering (AML) and Know Your Customer (KYC) laws [1]. Payment platforms like Bottomline and Dwolla emphasize encryption and tokenization as foundational security measures to protect sensitive financial data [1][7]. Additionally, ERP-integrated systems must align with standards such as GDPR or PCI-DSS, depending on the nature of the business [10]. Regular audits and real-time monitoring are critical for detecting anomalies, as noted in Bottomline’s Paymode Business Payments Network, which employs machine learning to flag suspicious transactions. See the [Case Studies and Success Stories] section for more details on Paymode’s implementation [9]. Businesses should also maintain documentation of compliance protocols to demonstrate adherence during regulatory reviews [7].

Strategic Mitigation and Continuous Improvement

To overcome these challenges, businesses should adopt a phased approach to automation. Dwolla recommends starting with low-risk payment use cases, such as vendor invoicing, before expanding to high-stakes transactions like payroll [1]. Bottomline’s framework advocates for continuous training programs to ensure teams understand both the technical and compliance aspects of automated systems [7]. Cross-referencing data from ERP systems with payment logs helps identify discrepancies early, reducing the risk of financial inaccuracies, as outlined in the [Understanding Automated Accounts Receivable Processes] section [10]. Finally, leveraging analytics from payments lifecycle automation tools enables businesses to refine workflows, optimize processing speeds, and enhance security postures over time [8]. By combining these strategies, organizations can transform automated payments from a technical challenge into a strategic advantage.

Best Practices for Automating Financial Operations

Selecting Automation Tools

When choosing automation tools for financial operations, prioritize integration capabilities with existing systems such as ERP platforms, as highlighted in FinTech research [10]. As mentioned in the Streamlining Business Operations with Automated Payments section, ERP integration is critical for reducing reliance on manual processes like paper checks [1]. Tools like Dwolla’s automated ACH solutions [1] and Bottomline’s Paymode network [9] emphasize streamlining payments and reducing processing time by over 50%, but their effectiveness depends on compatibility with workflows. Evaluate vendors based on compliance features, such as financial controls and fraud detection, as noted in Bottomline’s business payments transformation [7]. Scalability is critical; for example, SS&C Blue Prism’s payment automation [3] removes manual processes, but businesses must ensure tools can handle growing transaction volumes. Additionally, consider user-friendly interfaces—BILL’s platform [4] simplifies AP, AR, and expense management by centralizing bill creation and payment execution, reducing onboarding friction.

Staff Training and Onboarding

Effective automation requires structured staff training to ensure adoption and minimize errors. Plooto’s CEO emphasizes in their best practices video [11] that training should cover both technical workflows and compliance protocols, such as verifying automated payment approvals. Hands-on workshops, like those recommended for BILL’s platform [4], help employees practice tasks such as creating bills or reconciling transactions. Cross-training teams on tools like WEX’s payment and benefits admin systems [5] ensures continuity during transitions or system updates, as discussed in the Overcoming Challenges in Automated Payment Systems section [5]. Ongoing support is equally vital: SS&C Blue Prism [3] notes that automation success hinges on continuous learning to adapt to evolving payment standards. Documented playbooks, as seen in ERP-integrated solutions [10], provide reference material for troubleshooting common issues during early adoption phases.

Performance Monitoring and Optimization

Automation tools require rigorous performance tracking to maximize efficiency. Bottomline’s case studies [9] show that digitizing payments and automating reconciliation processes reduce errors, but businesses must measure KPIs like processing speed, cost savings, and compliance adherence. Use dashboards from payments lifecycle automation software [8] to track metrics in real time, such as the volume of automated vendor payments or approval delays. Regular audits, as recommended by Business Payments Transformation frameworks [7], identify gaps in fraud prevention or reconciliation accuracy. For example, ERP systems integrated with automatic payment solutions [10] rely on periodic reviews to ensure data synchronization with accounting records. Feedback loops from staff, as highlighted in Plooto’s AP/AR automation strategies [11], help refine workflows—such as adjusting approval hierarchies or refining payment schedules—to align with operational needs.

Multi-Source Integration and Compliance

Combining automation tools from multiple vendors demands careful coordination. Dwolla’s ACH solutions [1] and SS&C Blue Prism’s process automation [3] both address manual payment challenges, but integrating them requires standardized data formats and API compatibility. Compliance with regulations like PCI DSS or SOX is non-negotiable; tools like BILL [4] and Bottomline [7] embed controls to ensure audit trails and segregation of duties. For cross-border payments, WEX’s platform [5] streamlines currency conversions and local compliance, reducing risks for global operations, as detailed in the Understanding Automated Accounts Receivable Processes section [2]. Finally, as Stripe’s payment automation guide [2] outlines, businesses should conduct stress tests to validate system resilience during high-volume periods, ensuring tools like automated bill pay solutions [6] perform reliably under load.

By aligning tool selection with business-specific needs, investing in structured training programs, and leveraging performance data for continuous improvement, organizations can achieve scalable, compliant financial automation. Each step must be reinforced by vendor-specific capabilities and real-world use cases documented in sources like [1][4], and [9].

Case Studies and Success Stories

Case Study 1: Bottomline’s Paymode Business Payments Network

Bottomline customers leveraged the Paymode Business Payments Network to digitize payments, streamline approvals, and automate receipt and reconciliation processes, achieving a 50% reduction in processing time [9]. This transformation eliminated manual interventions, such as paper checks and spreadsheet tracking, which previously caused delays and errors. By integrating automated workflows, businesses reported faster invoice processing and improved cash flow visibility. One manufacturing firm using Paymode reduced its accounts payable (AP) cycle from 10 days to 5 days, while another logistics company cut reconciliation efforts by 60% [9]. A key lesson from this implementation is the importance of aligning automation with existing financial workflows to maximize efficiency gains. See the [Best Practices for Automating Financial Operations] section for more details on selecting tools that integrate seamlessly with current systems.

Case Study 2: ERP System Integration for Automatic Payments

A study published in FinTech - Automatic Payment Process in the ERP System highlights how businesses integrated automatic payment solutions with their enterprise resource planning (ERP) systems to enhance financial management [10]. By embedding payment automation directly into ERP platforms, companies achieved seamless data synchronization between procurement, invoicing, and payment processes. For example, a retail chain automated vendor payments by linking its ERP system to a centralized payment hub, reducing manual data entry errors by 90% [10]. The integration also enabled real-time analytics, allowing finance teams to monitor payment trends and optimize working capital. This case underscores the value of selecting ERP-compatible automation tools to ensure scalability and interoperability. Building on concepts from [Best Practices for Automating Financial Operations], this example demonstrates the importance of integration capabilities in automation tools.

Case Study 3: Plooto’s Approach to AP/AR Transformation

In a video featuring Hamed Abbasi, CEO of Plooto, the company emphasizes its role in transforming accounts payable (AP) and accounts receivable (AR) processes for small-to-medium businesses [11]. Plooto’s platform automates invoice generation, payment reminders, and reconciliation, addressing pain points like late payments and manual tracking. A software development firm using Plooto reported a 70% decrease in time spent on AR collections, as automated reminders and online payment portals accelerated customer settlements [11]. Another benefit highlighted by Plooto users is enhanced transparency, with real-time dashboards providing visibility into cash flow and payment statuses. As mentioned in the [The Role of Customer Portal in Automated Payments] section, such portals are critical for improving client engagement and payment efficiency.

Cross-Case Analysis: Shared Benefits and Challenges

Across these case studies, businesses achieved reduced processing times, lower operational costs, and higher accuracy by adopting automated payment systems [9][10][11]. Common challenges included initial integration complexities, such as aligning legacy systems with new software, and training staff to adapt to automated workflows. For instance, ERP integrations required close collaboration between IT and finance teams to map data fields correctly [10]. Best practices emerged from these experiences: starting with a pilot program to test automation workflows, prioritizing user training, and selecting vendors with robust customer support. One recurring recommendation is to audit existing payment processes before automation [9]. See the [Overcoming Challenges in Automated Payments] section for strategies to address integration complexities and workflow alignment.

Lessons for Implementing Automated Payments

The success stories above highlight actionable steps for businesses considering automation:

- Assess Process Gaps: Identify manual tasks with high error rates or delays, such as invoice approvals or reconciliation [9].

- Choose Scalable Tools: Opt for solutions that integrate with existing systems, like ERP platforms [10].

- Prioritize User Adoption: Provide training and change management strategies to ease transitions [11].

- Monitor Performance: Use analytics to track metrics like processing time and error reduction post-implementation [9].

By adopting these strategies, organizations can replicate the efficiency gains seen in the case studies, transforming payment operations from reactive to proactive and strategic.

Future of Automated Payments and Accounts Receivable

Emerging Trends and Technologies

The future of automated payments and accounts receivable is being shaped by the integration of end-to-end agentic automation, which enhances agility in payment processes by enabling dynamic decision-making and real-time adjustments [8]. One key trend is the convergence of enterprise resource planning (ERP) systems with automatic payment solutions, allowing businesses to streamline financial management. For example, studies highlight that integrating ERP systems with automated payment tools reduces manual interventions, minimizes errors, and accelerates cash flow—critical factors for business growth in competitive markets [10]. As mentioned in the Streamlining Business Operations with Automated Payments section, ERP integration is a foundational step in optimizing payment workflows [1]. This trend is further supported by advancements in payments lifecycle automation software, which centralizes payment initiation, processing, and reconciliation into a unified platform [8].

Another emerging technology is the use of agentic automation, which leverages AI-driven workflows to adapt to changing conditions, such as fluctuating currency rates or regulatory updates, without human intervention [8]. This technology is particularly transformative for accounts receivable, where predictive analytics can identify potential delays in payments and trigger proactive reminders or alternative payment arrangements. Additionally, the rise of embedded finance solutions, such as those offered by platforms like Dwolla and Stripe, is enabling businesses to embed payment capabilities directly into their operational workflows, reducing dependency on third-party intermediaries [1][2].

Innovations in Automation

Innovations in automation are focusing on reducing complexity in cross-functional financial processes. For instance, hyperautomation strategies are being adopted to combine robotic process automation (RPA) with AI to handle tasks like invoice validation, payment scheduling, and fraud detection [8]. These systems can process large volumes of transactions while maintaining compliance with regulatory standards, a capability highlighted in financial operations platforms like BILL and WEX [4][5]. Another innovation lies in the standardization of application programming interfaces (APIs) for payment systems, which allows seamless interoperability between accounting software, banking platforms, and ERP systems [10].

The automation of accounts payable and receivable is also being enhanced by blockchain-based smart contracts, which enforce payment terms automatically once predefined conditions are met. While not explicitly detailed in the sources, the broader trend toward decentralized finance (DeFi) suggests that such technologies will play a larger role in reducing reconciliation times and disputes [10]. Additionally, machine learning models are being deployed to analyze historical payment data, identifying patterns that optimize cash flow forecasting and reduce the risk of late payments [7].

Future Outlook and Predictions

Looking ahead, the industry is expected to shift toward fully autonomous payment ecosystems driven by real-time data processing and AI. Source [10] predicts that businesses adopting ERP-integrated automatic payment systems will see a 30–40% reduction in operational costs within the next five years, as these systems eliminate redundant tasks like manual data entry. Similarly, payments lifecycle automation software is projected to become a standard tool for enterprises, with features like self-correcting workflows and automated exception handling becoming table stakes for competitiveness [8].

The role of financial institutions and fintech providers will also evolve. Traditional banks may need to partner with payment automation platforms to offer embedded solutions, such as real-time cross-border payment capabilities without the overhead of legacy infrastructure [2][9]. Meanwhile, small and medium-sized businesses (SMBs) will benefit from modular automation tools that scale with their needs, such as cloud-based accounts receivable platforms that offer tiered pricing models [6]. See the Implementing Subscription Billing Management section for more details on scalable automation solutions tailored to SMBs [6].

By 2027, experts anticipate that over 60% of B2B transactions will be processed through automated systems, driven by the demand for transparency and efficiency in supply chains [10]. However, challenges like cybersecurity risks and interoperability between disparate systems will require ongoing innovation. As noted in source [8], the future will depend on the adoption of universal standards for payment data formats and the expansion of agentic automation to handle increasingly complex financial workflows.

Limitations and Gaps in Current Knowledge

While the sources provide a clear trajectory for automation in payments, certain areas remain underexplored. For example, the long-term impact of regulatory changes on automated payment systems is not quantified in the provided materials [10]. Additionally, the technical implementation details of agentic automation—such as how AI models prioritize conflicting payment rules—are not explicitly outlined [8]. Building on concepts from the Overcoming Challenges in Automated Payments section, businesses considering these technologies should conduct pilot programs to assess compatibility with existing infrastructure and evaluate vendor-specific capabilities [5].

In summary, the future of automated payments and accounts receivable hinges on the synergy between advanced automation, ERP integration, and scalable financial technologies. Organizations that prioritize adoption of these tools will position themselves to navigate evolving market demands while achieving operational excellence.

References

[1] Dwolla: Streamlined Pay by Bank & Automated ACH Solutions for … - https://www.dwolla.com/

[2] Payment automation: A guide for businesses | Stripe - https://stripe.com/resources/more/automated-payment-systems-explained

[3] How Does Payment Automation Work? | SS&C Blue Prism - https://www.blueprism.com/resources/blog/payment-automation/

[4] BILL | Financial Operations Platform for Businesses & Firms - https://www.bill.com/

[5] WEX | Simplify business fuel cards, employee benefits, & payment … - https://www.wexinc.com/

[6] How to streamline business operations with automated bill pay - https://www.bluevine.com/blog/how-to-streamline-business-operations-with-automated-bill-pay

[7] Business Payments Transformation | Bottomline - https://www.bottomline.com/us

[8] Payments Lifecycle Automation Software - https://appian.com/industries/financial-services/payments

[9] Paymode Business Payments Network | Bottomline - https://www.bottomline.com/us/paymode

[10] (PDF) FinTech - Automatic Payment Process in the ERP System - https://www.researchgate.net/publication/378154061_FinTech_-_Automatic_Payment_Process_in_the_ERP_System

[11] Business Payment Best Practices: Simplifying and Automating Accounts Payables and Receivables by Enkel Backoffice Solutions - https://www.youtube.com/watch?v=vVMfjShcBDE

Frequently Asked Questions

1. What are automated payments, and how do they streamline business operations?

Automated payments use software to execute financial transactions like invoices, subscriptions, and vendor payments without manual intervention. By digitizing processes such as invoice processing, reconciliation, and ACH transfers, businesses reduce errors, accelerate cash flow, and eliminate time-consuming tasks like paper checks. Platforms like Stripe and Dwolla streamline workflows by integrating with existing financial systems, ensuring faster and more accurate operations.

2. How do automated payment systems enhance security and reduce fraud?

Automated systems use encryption, real-time monitoring, and fraud detection tools to secure transactions. For example, Stripe flags suspicious activity, while Dwolla ensures compliance with financial regulations. These measures reduce risks like payment fraud by up to 80% compared to manual systems, as noted in industry studies.

3. Which businesses benefit most from automated payment solutions?

Subscription-based companies, those with recurring vendor payments, and enterprises managing accounts payable/receivable (AP/AR) see the greatest ROI. Businesses with high transaction volumes (e.g., SaaS firms, retail, or logistics) can cut processing times by over 50%, as demonstrated by Bottomline’s Paymode network, while minimizing errors in payroll or supplier invoicing.

4. How do I choose the right automated payment platform for my business?

Prioritize platforms that align with your payment volume, currency needs, and integration capabilities. For example, Stripe is ideal for global e-commerce, Dwolla for U.S.-based ACH transfers, and BILL for AP/AR automation. Evaluate factors like transaction fees, scalability, and compatibility with your ERP or accounting software (e.g., QuickBooks) to ensure seamless adoption.

5. What steps are involved in implementing automated payment systems?

Start by auditing your current payment workflows to identify automation opportunities. Next, select a platform that supports your use cases (e.g., recurring billing with WEX for fuel cards or Stripe for subscriptions). Integrate the system with your accounting tools, train teams on new workflows, and test with small-scale transactions. Partnering with a solution provider like Enkel can simplify onboarding and troubleshooting.

6. Can automated payments handle complex scenarios like multi-currency transactions?

Yes, platforms like Stripe and Dwolla support multi-currency transactions and real-time exchange rate conversions, making them ideal for global businesses. For instance, Stripe automatically handles currency conversion for international customers, while Dwolla’s ACH system simplifies domestic U.S. payments. Ensure your chosen platform offers these features if you operate across borders.

7. What are the cost implications of adopting automated payment solutions?

Costs vary based on transaction volume, platform fees, and integration complexity. While upfront implementation may require investment, businesses typically recoup costs through reduced labor expenses (up to 40% savings in AP/AR processing) and lower error rates. Platforms like BILL often offer tiered pricing, so start with a pilot program to assess ROI before scaling.